CoreLogic: Annual Mortgage Delinquency Rate Drops for 5th Straight Month to 10-Month Low

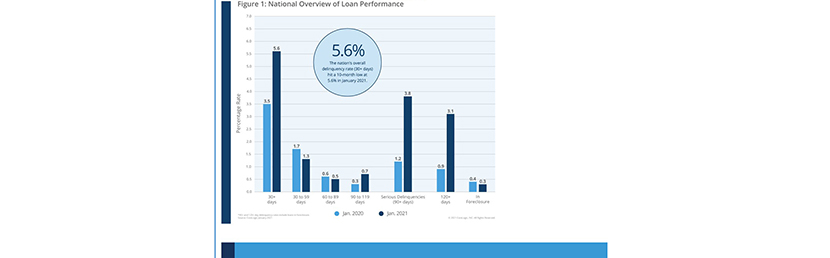

(Graphic courtesy CoreLogic.)

CoreLogic, Irvine, Calif., said while mortgage delinquencies rose month over month in January, overall delinquency rates fell for the fifth straight month to the lowest level since last March.

The company’s monthly Loan Performance Insights Report said 5.6% of all mortgages in the U.S. were in some stage of delinquency in January (30 days or more past due, including those in foreclosure), representing a 2.1-percentage point increase in the overall delinquency rates compared to a year ago. However, nationally, the overall delinquency has been declining month to month since August.

Other key report findings:

• Early-Stage Delinquencies (30 to 59 days past due): 1.3%, down from 1.7% in a year ago.

• Adverse Delinquency (60 to 89 days past due): 0.5%, down from 0.6% a year ago.

• Serious Delinquency (90 days or more past due, including loans in foreclosure): 3.8%, up from 1.2% a year ago but 0.5 percentage points below the August 2020 peak.

• Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, down from 0.4% a year ago.

• Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.7%, up from 0.6% a year ago.

“While delinquency rates are higher than we would like to see, they continue to decline,” said Frank Martell, president and CEO of CoreLogic. “At the same time, foreclosure rates remain at historic lows. This is a good sign, and considering the improving picture regarding the pandemic and climbing employment rates, we are looking at the potential for a strong year of recovery.”

“The transition rate from current to delinquent this January was the lowest in twelve months, which is another hopeful sign that family finances are beginning to improve,” said Frank Nothaft, chief economist at CoreLogic. “Further, the transition from 30- to 60-day delinquency was the lowest since last March and is likely to decline further with strong job growth. The consensus view among economists is that the 2021 economy will expand at the fastest rate since 1984.”

The report noted, however, millions of homeowners remain in mortgage forbearance plans that were originally scheduled to begin expiring in March; the Mortgage Bankers Association this morning said 2.3 million homeowners remain in forbearance plans (see story above).

CoreLogic said all U.S. states and nearly all metro areas logged increases in annual overall delinquency rates in January. Hawaii and Nevada (up 4.2 and 4.1 percentage points, respectively) logged the largest annual increase in overall delinquency rates, as these states are dependent on tourism, which has been slow to recover.

Among metros, Odessa, Texas, experienced the largest annual increase with 9.7 percentage points, as the area is still recovering from significant job loss in the oil industry. Other metro areas with significant overall delinquency increases included Midland, Texas (up 7.7 percentage points) and Kahului, Hawaii (up 7 percentage points).