Frank Nothaft, who served for the past seven years as Chief Economist with CoreLogic, Irvine, Calif., passed away unexpectedly on June 5. He was 66.

Tag: Frank Nothaft

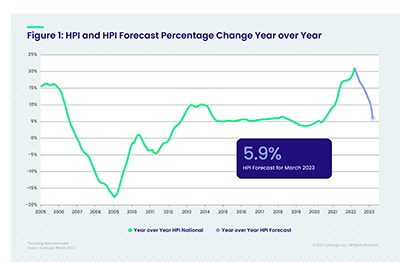

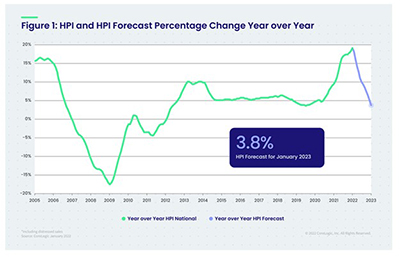

CoreLogic: U.S. Annual Home Price Growth Exceeds 20% in March

CoreLogic, Irvine, Calif., said U.S. home prices continued to post significant year-over-year gains in March, up by 20.9%, another record high.

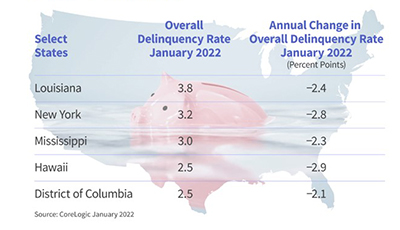

CoreLogic: Mortgage Delinquencies at 23-Year Low

CoreLogic, Irvine, Calif., said mortgage delinquencies fell in January to their lowest level since 1999.

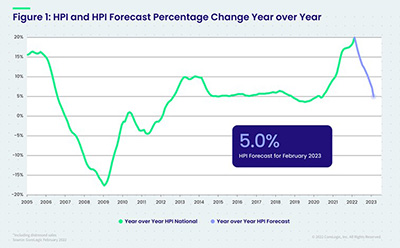

CoreLogic: Annual Home Price Growth Hits New High; Cooling on the Way

Another day, another report of record-high home price appreciation.

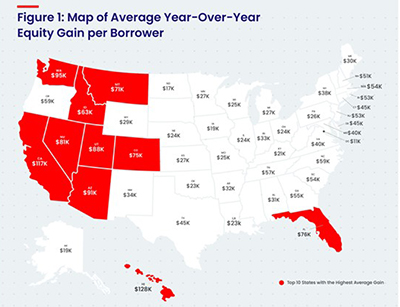

CoreLogic: Homeowners in Negative Equity at Lowest Level in 12 Years

CoreLogic, Irvine, Calif., said just 2.1% of U.S. homeowners with a mortgage were underwater as of the fourth quarter, the lowest level since 2010, as borrowers gained more than $3.2 trillion in equity in 2021.

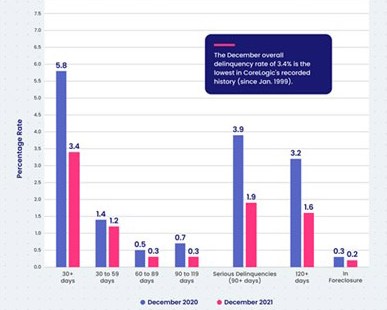

CoreLogic: Mortgage Delinquency Rate Falls to New Low

CoreLogic, Irvine, Calif., said overall mortgage delinquencies fell to their lowest point yet amid improved employment and growing home equity.

CoreLogic: Home Price Appreciation at 45-Year High

CoreLogic, Irvine, Calif., said annual home price appreciation in January jumped to the highest level in at least 45 years.

Housing Report Roundup, Mar. 1, 2022

Here are summaries of recent housing market reports that came across the MBA NewsLink desk.

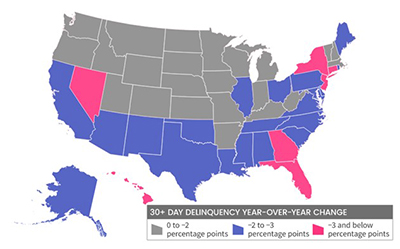

CoreLogic: Delinquencies Fall Below Pre-Pandemic Levels

Ahead of this Thursday’s National Delinquency Survey from the Mortgage Bankers Association, Corelogic, Irvine, Calif., reported November’s loan delinquency rates fell to levels last seen before the coronavirus pandemic.

CoreLogic: Home Price Gains Averaged 15% in 2021

CoreLogic, Irvine, Calif., said consumer desire for homeownership against persistently low supply of for-sale homes created one of the hottest housing markets in decades in 2021 — and spurred record-breaking home price growth.