CoreLogic Home Price Index Hits Record High

The CoreLogic Home Price Index reported annual home price growth in July jumped to the highest rate in its 45-year history.

The report said nationally, home prices increased by 18% annually in July, the largest 12-month growth in the U.S. index since the series began (January 1976). On a month-over-month basis, home prices increased by 1.8% from June.

Appreciation of detached properties (19.7%) was again the highest measured since inception of the index and nearly double that of attached properties (11.6%) as prospective buyers continue to seek more living space and lower density communities.

At the state level, Idaho and Arizona saw strongest price growth at 33.6% and 28.4%, respectively. Utah also sa a 25.7% year-over-year increase as home buyers seek out more affordable locations with lower population density and attractive outdoor amenities. At the metro level, home prices rose sharply in the west with Twin Falls, Idaho, seeing the highest year-over-year increase for a third consecutive month at 39.8%. Bend, Ore., ranked second at 37.1%.

“July’s annual home price growth was the most that we have ever seen in the 45-year history of the CoreLogic Home Price Index,” said CoreLogic Chief Economist Frank Nothaft. “This price gain has far exceeded income growth and eroded affordability. In the coming months this will temper demand and lead to a slowing in price growth.”

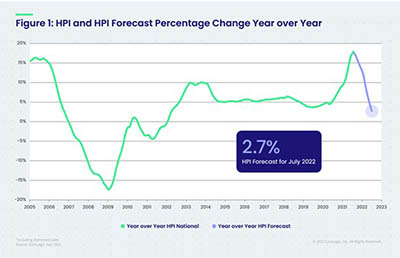

The CoreLogic Home Price Forecast projects home price gains to slow to a 2.7% increase by July 2022, as ongoing affordability challenges deter some potential buyers and an expected uptick in new for-sale listings cause a slowdown in home price growth.

The report noted with mortgage rates remaining near record lows, ongoing challenges of persistent demand and constricted supply continue to put upward pressure on home prices. A recent CoreLogic survey of consumers looking to buy homes reported on average, 65.8% of respondents across all age cohorts strongly prefer standalone properties compared to other property types. Given the widespread demand, and considering the number of standalone homes built during the past decade, the single-family market is estimated to be undersupplied by 4.35 million units by 2022.

“Home price appreciation continues to escalate as millennials entering their prime home buying years, renters looking to escape skyrocketing rents and deep pocketed investors drive demand,” said Frank Martell, president and CEO of CoreLogic. “On the supply side, it is also the result of chronic under building, especially of affordable stock. This lack of supply is unlikely to be resolved over the next 5 to 10 years without more aggressive incentives for builders to add new units.”