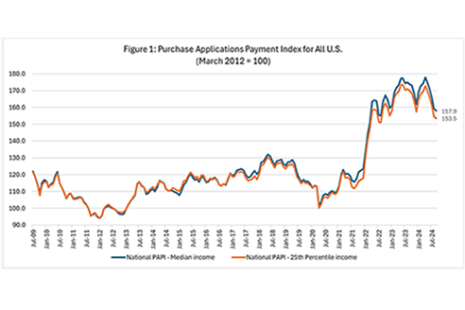

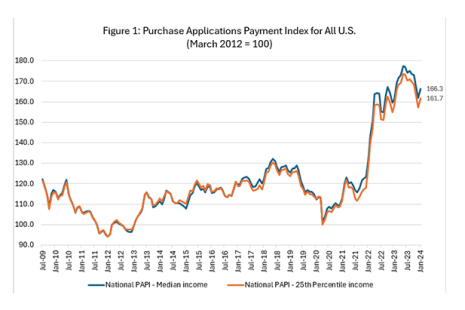

Homebuyer affordability improved in September, with the national median payment applied for by purchase applicants decreasing to $2,041 from $2,057 in August. This is according to MBA’s Purchase Applications Payment Index, which measures how new monthly mortgage payments vary across time – relative to income.

Tag: Edward Seiler

MBA’s Edward Seiler Elected President of the International Union for Housing Finance

Edward Seiler, Mortgage Bankers Association Associate Vice President for Housing, and Economics Executive Director, Research Institute for Housing America, was recently elected President of the International Union for Housing Finance.

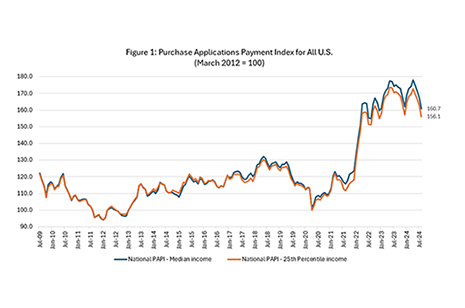

MBA: Mortgage Application Payments Decreased 3.9% to $2,057 in August

Homebuyer affordability improved in August, with the national median payment applied for by purchase applicants decreasing to $2,057 from $2,140 in July. This is according to MBA’s Purchase Applications Payment Index.

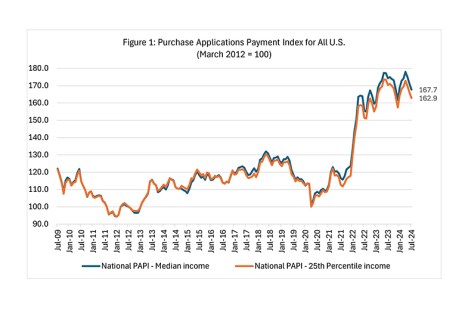

Mortgage Application Payments Decreased 1.3% to $2,140 in July

Homebuyer affordability improved in July, with the national median payment applied for by purchase applicants decreasing to $2,140 from $2,167 in June.

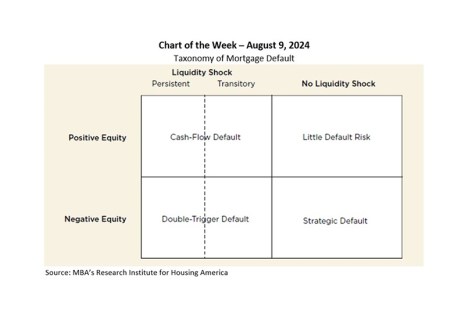

MBA Chart of the Week: Taxonomy of Mortgage Default

The Research Institute for Housing America recently released a special report that looked at the lessons learned from the Great Financial Crisis, the COVID-19 pandemic, and other past episodes of default, to understand how to design a more robust mortgage system that proactively supports sustainable homeownership.

MBA RIHA: Mortgage Industry Should Develop New Intervention Policies for Distressed Borrowers

According to a new report released by the Mortgage Bankers Association’s Research Institute for Housing America (RIHA) examining current mortgage design models, underwriting standards, and intervention policies would help alleviate market pressures resulting from high levels of mortgage defaults.

MBA: Mortgage Application Payments Increased 2.5% to $2,256 in April

Homebuyer affordability declined in April, with the national median payment applied for by purchase applicants increasing to $2,256 from $2,201 in March.

MBA: Mortgage Application Payments Remained Flat in March

Homebuyer affordability declined in March, with the national median payment applied for by purchase applicants increasing slightly to $2,201 from $2,184 in February, the Mortgage Bankers Association reported.

MBA: Mortgage Application Payments Increased 2.4% in February

Homebuyer affordability declined in February, with the national median payment applied for by purchase applicants increasing to $2,184 from $2,134 in January. This is according to the Mortgage Bankers Association’s Purchase Applications Payment Index, which measures how new monthly mortgage payments vary across time–relative to income–using data from MBA’s Weekly Applications Survey.

MBA: Mortgage Application Payments Placeholder

Homebuyer affordability declined in January, with the national median payment applied for by purchase applicants increasing to $2,134 from $2,055 in December. This is according to the MBA Purchase Applications Payment Index, which measures how new monthly mortgage payments vary across time – relative to income – using data from MBA’s Weekly Applications Survey.