MBA Chart of the Week: Demographics of Potential First-Time Homebuyers

This year has been tough for the housing market in terms of total originations. MBA estimates this year’s total originations will be $1.64 trillion, the November FHA Annual Report to Congress reports that FHA forward originations were down by over 18% from FY 2022 to FY 2023, and MBA’s Weekly Applications Survey shows that purchase applications are down by 30% year to date.

As we enter the holiday season, however, there is room for optimism. In December’s forecast, we predict that mortgage rates will steadily decline over the next couple of years and that total originations will increase by 22% and 17% in 2024 and 2025, respectively. Moreover, we are forecasting that purchase originations will exhibit a rebound—reaching $1.70 trillion in 2025 versus this year’s $1.33 trillion.

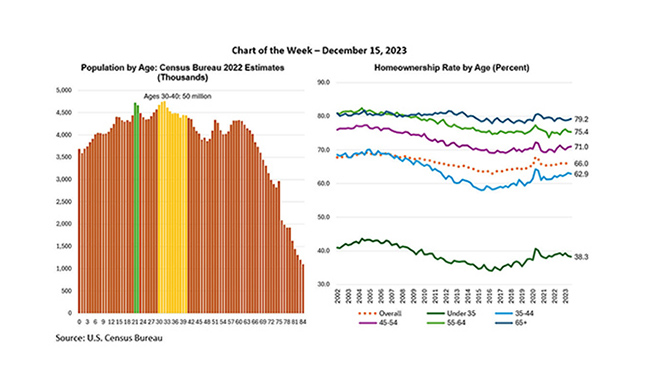

One of the main drivers for this optimism is the country’s demographics. In this week’s MBA Chart of the Week, we highlight this by looking at the large cohorts of potential first-time homebuyers. The left panel shows not only the large cohorts of Millennials who are in their prime first-time homebuying years (gold columns), but also the two large cohorts of Gen Zers (green columns) right behind them. The right panel emphasizes their likely large effect—homeownership rates among households under 35 years old have been below 40% in recent years (dark green line) but jump to almost 63% for homeowners ages 35-44 (light blue line).

But will there be enough homes for these young cohorts to purchase?

While the MBA Builder Applications Survey has highlighted that new home purchases have outperformed the broader purchase market in recent months, the right-most columns of the left panel also highlight that the Baby Boomer cohorts will slowly exit their homes allowing their existing residences to filter down to lower aged households.

Indeed, in his 2022 RIHA paper, Who Will Buy the Baby Boomers’ Homes When They Leave Them?, Gary Engelhardt estimates that there will be an excess supply of about a quarter of a million homes annually over the next decade from homeowners over the age of 50. Together, these indicate that there will be homes available for younger cohorts to purchase. If Millennials and Gen Z eventually behave similarly to earlier cohorts regarding homebuying and homeownership patterns, the demographics provide an additional reason for optimism for the mortgage industry.