Pending home sales continue to meet—and exceed—their potential, the National Association of Realtors reported yesterday.

Tag: Coronavirus

Despite Record-Low Interest Rates, Mortgage Applications Down in MBA Weekly Survey

Mortgage applications fell by nearly 5 percent for the week ending Sept. 25 from one week earlier despite the lowest 30-year fixed rate in the history of the Mortgage Bankers Association’s Weekly Mortgage Applications Survey.

Joe Ludlow of Advantage Systems on the Science of Financial Data

Joe Ludlow is Vice President for Irvine, Calif.-based Advantage Systems, a provider of accounting and financial management tools for the mortgage industry.

Joe Ludlow of Advantage Systems on the Science of Financial Data

Joe Ludlow is Vice President for Irvine, Calif.-based Advantage Systems, a provider of accounting and financial management tools for the mortgage industry.

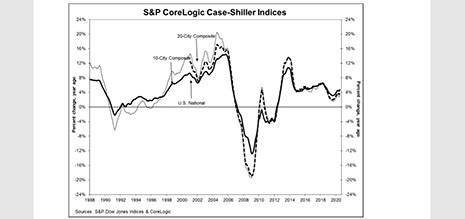

Case-Shiller Index Posts Nearly 5% Annual Home Price Gains

S&P Dow Jones Indices, New York said its S&P CoreLogic Case-Shiller Indices showed home prices continue to increase at a modest rate across the U.S.

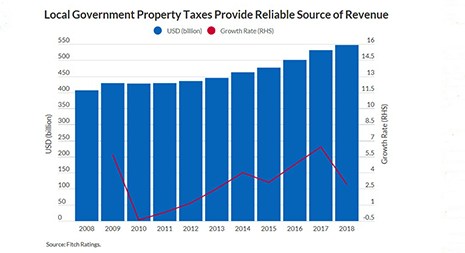

Fitch: Mortgage Delinquencies Won’t Affect Property Tax Payments

Fitch Ratings, New York, does not expect fiscal 2021 property tax collections to be meaningfully affected by mortgage forbearance programs or delinquencies, but potential for timing delays is “elevated.”

Despite Record-Low Interest Rates, Mortgage Applications Down in MBA Weekly Survey

Mortgage applications fell by nearly 5 percent for the week ending Sept. 25 from one week earlier despite the lowest 30-year fixed rate in the history of the Mortgage Bankers Association’s Weekly Mortgage Applications Survey.

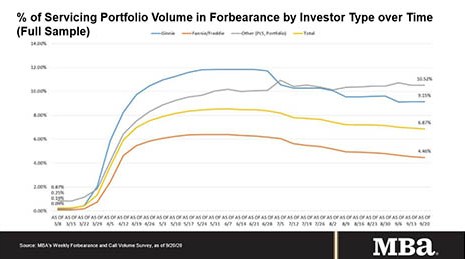

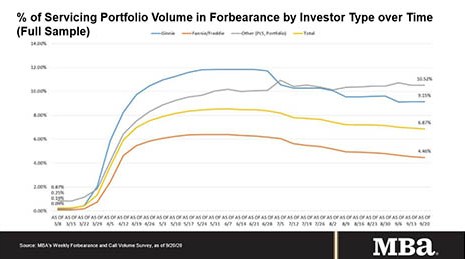

MBA: Share of Loans in Forbearance Drops to 6.87%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.87% of servicers’ portfolio volume as of September 20, from 6.93% the prior week. MBA estimates 3.4 million homeowners remain in forbearance plans.

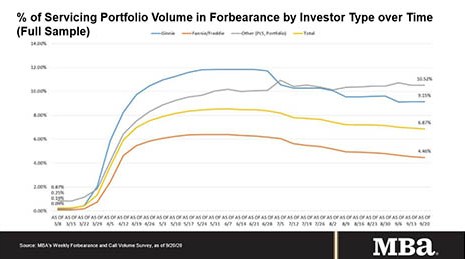

MBA: Share of Loans in Forbearance Drops to 6.87%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.87% of servicers’ portfolio volume as of September 20, from 6.93% the prior week. MBA estimates 3.4 million homeowners remain in forbearance plans.

MBA: Share of Loans in Forbearance Drops to 6.87%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.87% of servicers’ portfolio volume as of September 20, from 6.93% the prior week. MBA estimates 3.4 million homeowners remain in forbearance plans.