Temporary, alternative inspections methods help to demonstrate the reliability and benefits of bifurcation and may very well assist in the evolution of home appraisals.

Tag: Coronavirus

Fitch: Remote Working to Affect Housing Demand—But Not U.S. RMBS Ratings

Fitch Ratings, New York, said while remote working in the U.S. accelerated as a result of the coronavirus pandemic, and is reducing the importance of proximity to offices and causing migration from urban to suburban and exurban areas, it does not expect any material effect on the credit quality of its rated U.S. residential mortgage-backed securities pools.

Record-Low Interest Rates Spark Refi Surge in MBA Weekly Survey

We apparently haven’t seen a bottom in mortgage interest rates—and it got a lot of borrowers off their couches, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending October 2.

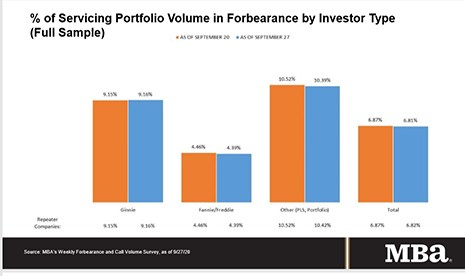

MBA: Share of Loans in Forbearance Falls to 6.81%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.81% of servicers’ portfolio volume as of Sept. 27, from 6.87% the prior week. MBA now estimates 3.4 million homeowners are in forbearance plans.

Along Came COVID: Emerging Tech Trends in Commercial Real Estate Finance

Emerging technologies and start-up firms proliferated in commercial real estate over the last several years. With the conventional wisdom being that while the single-family real estate finance industry has embraced new technologies and innovation, CRE was a laggard and therein lies a massive opportunity.

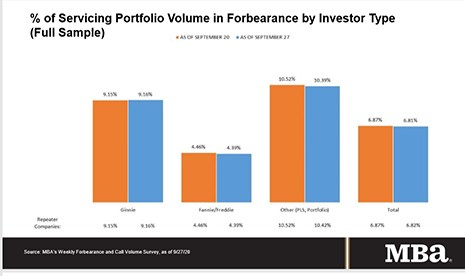

MBA: Share of Loans in Forbearance Falls to 6.81%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.81% of servicers’ portfolio volume as of Sept. 27, from 6.87% the prior week. MBA now estimates 3.4 million homeowners are in forbearance plans.

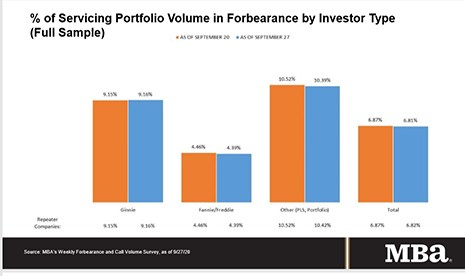

MBA: Share of Loans in Forbearance Falls to 6.81%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.81% of servicers’ portfolio volume as of Sept. 27, from 6.87% the prior week. MBA now estimates 3.4 million homeowners are in forbearance plans.

Joe Ludlow of Advantage Systems on the Science of Financial Data

Joe Ludlow is Vice President for Irvine, Calif.-based Advantage Systems, a provider of accounting and financial management tools for the mortgage industry.

Joe Ludlow of Advantage Systems on the Science of Financial Data

Joe Ludlow is Vice President for Irvine, Calif.-based Advantage Systems, a provider of accounting and financial management tools for the mortgage industry.

Joe Ludlow of Advantage Systems on the Science of Financial Data

Joe Ludlow is Vice President for Irvine, Calif.-based Advantage Systems, a provider of accounting and financial management tools for the mortgage industry.