Fitch: Mortgage Delinquencies Won’t Affect Property Tax Payments

Fitch Ratings, New York, does not expect fiscal 2021 property tax collections to be meaningfully affected by mortgage forbearance programs or delinquencies, but potential for timing delays is “elevated.”

This is critical for mortgage servicers, Fitch said, because they are obligated to advance property taxes when a borrower is not making mortgage payments and, because of the elevated number of delinquent loans and loans in forbearance, servicer liquidity could be affected. Unemployment levels remain high, and Fitch expects a slower economic recovery following a third-quarter bounce back. In the absence of further federal aid, mortgage delinquencies may increase, placing greater pressure on mortgage servicers.

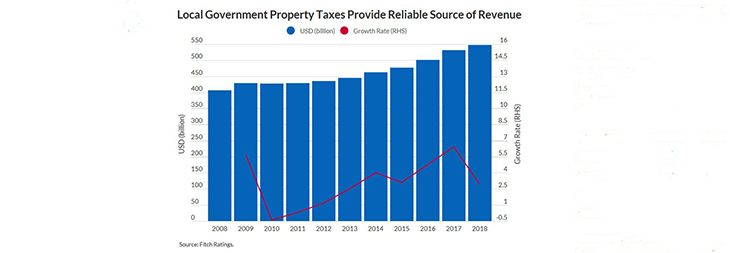

The issue is important for local governments as well, Fitch said, as property taxes have traditionally been a stable and predictable source of revenues, moderating higher volatility in more economically sensitive taxes, service charges and state aid. Fitch noted overall property tax collections saw minimal declines during the Great Recessio,n despite widespread mortgage defaults and foreclosures.

“Forbearance has been offered in greater numbers than during the Great Recession but is trending downward from its peak in June, “ Fitch said. The share of mortgages in forbearance was 6.87% as of September 20, per the Mortgage Bankers Association. Mortgages in forbearance are generally reported as delinquent, although some borrowers with loans in forbearance are still making payments on time.

The report noted few local governments postponed property tax deadlines or waived late payment fees for payers who can demonstrate they are affected by the coronavirus. Fitch said all of its rated local governments have sufficient liquidity, through internal resources, cash management tools or access to the short-term market, to offset this risk, which is reflected in higher ratings. Those local governments with weaker liquidity tend to be rated low investment-grade or non-investment grade.

The report also noted a majority of U.S. mortgages are pooled in securitizations as a tool for financing the loans, such as Ginnie Mae, Fannie Mae and Freddie Mac, which are also obligated to pay property taxes on their portfolios. The issue, Fitch said, could be with non-bank servicers.

“While most banks are unlikely to face near-term difficulties with advancing requirements, nonbank servicers, which have weaker credit profiles, are more challenged as they have greater loan exposure by dollar amount than banks,” Fitch said. “Many nonbank servicers secured additional lines of credit to make advances, and diversified entities benefitted from the GSE’s four-month limit on the obligation to advance P&I. So far, servicers have shown adequate liquidity to advance missed payments, and T&I are generally a smaller percentage of total monthly payments and do not materially add to servicers’ advancing obligations.”