Even when minorities do become homeowners, research shows that homeownership delivers fewer benefits than it does for white families—including significantly less home equity. Yet there are steps we as an industry can take toward leveling the playing field.

Tag: Coronavirus

Richard Ferguson: What We Can Do to Help Close the Homeownership Wealth Gap

Even when minorities do become homeowners, research shows that homeownership delivers fewer benefits than it does for white families—including significantly less home equity. Yet there are steps we as an industry can take toward leveling the playing field.

MBA: Loans in Forbearance Fall to Lowest Level in 5 Months

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

MBA: Loans in Forbearance Fall to 5-Month Low

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

RIHA Study: COVID-19’s Impact on Jobs, Ability to Make Housing, Student Debt Payments

During the first three months of the COVID-19 pandemic, nearly 11 million households fell behind on their rent or mortgage payments and 30 million individuals missed at least one student loan payment, according to new research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

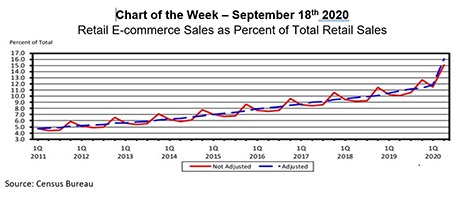

MBA Chart of the Week: Retail E-Commerce/Retail Sales

Even before the onset of the pandemic, retail properties were under the microscope. Practitioners spoke about the United States being “over-retailed” compared to other countries, about a shift to experiential retail with a focus on services rather than goods, and about how the rise in e-commerce is a challenge to bricks-and-mortar.

Monday Report: Red-Hot Housing Markets and a Time-Capsule Survey

This morning’s Monday Report features stories that confirm the housing markets remain hot, regardless of location or political preference; what that might mean for down payments; and a housing survey that, thanks to the coronavirus pandemic, was obsolete the moment it was released.

RIHA Study: COVID-19’s Impact on Jobs, Ability to Make Housing, Student Debt Payments

During the first three months of the COVID-19 pandemic, nearly 11 million households fell behind on their rent or mortgage payments and 30 million individuals missed at least one student loan payment, according to new research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

Housing Report Roundup

Welcome to the Friday Housing Report Roundup. Click on the link to see what’s happening.

GSEs: Recession-Era QC Has Lenders Well-Prepared for Current Crisis (MBA LIVE)

Speaking virtually at the Mortgage Bankers Association’s Risk Management, Quality Assurance and Fraud Prevention Forum, GSE analysts said despite challenges resulting from increased volumes, economic instability and a sharp spike in unemployment–as well an abrupt shift to remote working–lenders have shown adaptability and a commitment to loan quality.