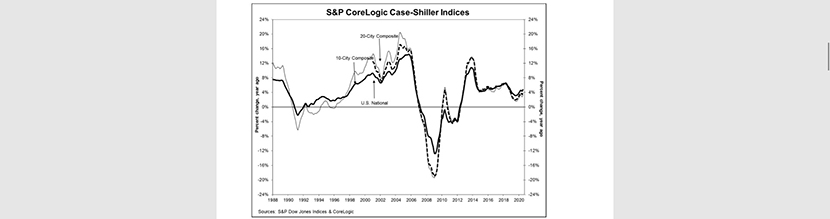

Case-Shiller Index Posts Nearly 5% Annual Home Price Gains

S&P Dow Jones Indices, New York said its S&P CoreLogic Case-Shiller Indices showed home prices continue to increase at a modest rate across the U.S.

Year over year, the U.S. National Home Price NSA Index reported a 4.8% annual gain in July, up from 4.3% in June. The 10-City Composite annual increase rose to 3.3%, up from 2.8% the previous month. The 20-City Composite posted a 3.9% year-over-year gain, up from 3.5% in June.

Phoenix led metros with a 9.2% year-over-year price increase, followed by Seattle at 7.0% increase and Charlotte at 6% increase. Sixteen of the 19 cities reported higher price increases in the year ending July from a year ago (data for the 20th city, Detroit, was not available for the report)

Month over month, the National Index posted an 0.8% increase, while the 10-City and 20-City Composites both posted increases of 0.6% before seasonal adjustment in July. After seasonal adjustment, the National Index posted a month-over-month increase of 0.4%, while the 10-City and 20-City Composites posted increases of 0.5% and 0.6%, respectively. In July, 18 of 19 cities (excluding Detroit) reported increases before seasonal adjustment, while 18 of the 19 cities reported increases after seasonal adjustment.

“The strength of the housing market was consistent nationally,” said Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy with S&P Dow Jones Indices. “In previous months, we’ve noted that a trend of accelerating increases in the National Composite Index began in August 2019. That trend was interrupted in May and June, as price gains decelerated modestly, but now may have resumed. Obviously more data will be required before we can say with confidence that any COVID-related deceleration is behind us.”

The report said average home prices for the metros within the 10-City and 20-City Composites are back to their winter 2007 levels.

“Housing market resiliency persisted throughout the summer as traditional first-time buyers sought refuge in larger square footage and outdoor space, and buyers who had not been financially impacted by the pandemic sought second homes in resort, beach and mountain areas,” said CoreLogic Deputy Chief Economist Selma Hepp. “Demand will likely keep home price growth strong over the coming months. And, continued price growth will help insulate homeowners’ equity position, which will be particularly helpful to owners who have been financially impacted by the pandemic and opted for a forbearance program. Those homeowners may be able to sell a home without going through a short sale or a foreclosure.”