September CMBS Delinquency, Special Servicing Rates Drop

Fitch Ratings, New York, and Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate continued it steady fall in September.

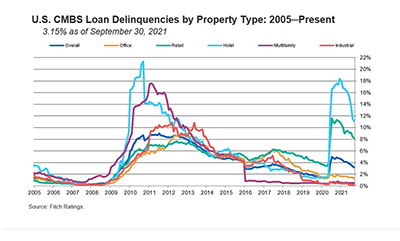

Fitch said its CMBS delinquency rate metric fell 18 basis points in September to 3.15 percent, mostly due to strong hotel and retail resolution volume and steady new issuance activity. It expects the delinquency rate to dip below 3 percent by year end, “outperforming the prediction made at the start of the year.”

CMBS resolutions totaled $1.5 billion in September compared to $1.6 billion in August; new delinquencies equaled $614 million in September, consistent with the $610 million seen in August, Fitch reported. CMBS 30-day delinquencies fell below the billion-dollar mark to $992 million.

Trepp Research Analyst Maximillian Nelson said CMBS delinquency and special servicing rates both improved in September. “On the flip side of the coin, however, are the less-than-stellar economic indicators,” he said. “Besides the jobs report that came in well below estimates, continued supply chain woes and concerns around the debt ceiling, the news around lodging and office properties is less than ideal.”

Nelson said the CMBS special servicing rate fell 30 basis points in September to 7.48 percent. “This month’s drop marks one year of consistent declines in the special servicing rate following the initial rise due to the economic impact of COVID-19,” he said.

The special servicing rate has fallen 300 basis points over the past 12 months, Trepp reported. Just over $355 million in CMBS debt across 15 notes transferred to special servicing in September. Office properties backed by CMBS made up nearly 60 percent of the newly transferred balance.

Kroll Bond Rating Agency, New York, said CMBS private label pricing volume ended September at $12.3 billion, bringing year-to-date issuance total to $69 billion. New issuance eclipsed the $58.4 billion seen through September 2019 and is up more than 75 percent from last year’s first three quarters .

KBRA noted up to 18 CMBS deals could launch during October, including two conduits, eight to 10 single-borrower transactions, one Freddie Mac K-Series and as many as five commercial real estate collateralized loan obligations.