CMBS Defeasance Snaps Back

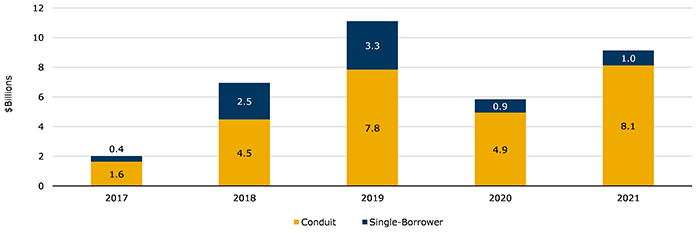

Kroll Bond Rating Agency, New York, reported commercial mortgage-backed securities defeasance volume rebounded strongly last year after falling by nearly half in 2020.

Defeasance volume totaled $9.1 billion in 2021, with nearly half of that total closing in the last quarter. Conduit loan defeasance represented much of the total at $8.1 billion, its highest level in five years.

“Defeasance moved higher in 2018 and 2019 before falling in 2020, a pattern that was similar to commercial real estate sales volume in those years,” said Larry Kay, Senior Director with KBRA. “The market rebounded strongly last year as an increased level of certainty brought buyers and sellers to the table.”

In its monthly CMBS Trends report, KBRA said defeasance increased 88 percent year-over-year. “Rising sales activity, along with higher asset prices and low interest rates, were the primary catalysts for the higher defeasance volume in 2021,” Kay said.

The report noted many real estate owners wanted to lock in their gains last year through property sales or refinancing. “In addition, with the Federal Reserve in December messaging three interest rate increases in 2022, those on the sidelines may have decided to enter the playing field to take advantage of the current low interest rate environment,” the report said.

KBRA reported the weighted-average coupons of conduit loans defeased last year was 4.7 percent, compared to 3.5 percent for KBRA-rated conduit weighted-average coupons. “In addition to this WAC advantage borrowers may have looked to close transactions by year-end for tax purposes,” the report said.

The report said multifamily defeasance activity has surpassed all other property types over the past five years and accounted for 27.4 percent of conduit defeasance volume last year. “Multifamily continues to be a favored asset class supported by strong property fundamentals and price growth,” KBRA said. “Strong levels of demand based on the economic recovery, demographics and migration trends should continue to support price growth.

The office sector ranked second at 25.7 percent of conduit defeasance volume last year. “Even with the uncertain outlook for office properties, some large office loans were defeased,” KBRA said. The largest office defeasance was a $224 million loan for One Memorial, a 369,436-square-foot property in Cambridge, Mass.

Industrial and self-storage also experienced high defeasance volume, representing 10.7 percent and 10 percent of 2021 defeasance activity, KBRA said. These totals were 80 percent and 38 percent higher, respectively, than any of the past four years.