CMBS Delinquency Rate Dips; Forecast Calls for 2023 Increase

Fitch Ratings, New York, said the commercial mortgage-backed delinquency rate fell six basis points in October to 1.89%, but forecast it could increase significantly in 2023.

Fitch said resolutions totaled $839 million in October, up from $712 million in September. New 60-plus day delinquencies fell to $364 million from $678 million in September. October’s 30-day delinquencies totaled $645 million, compared to $670 million in September.

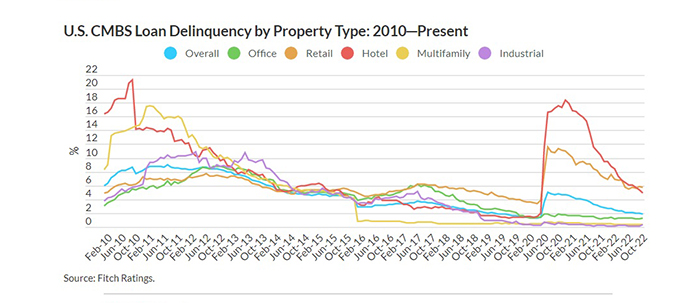

The industrial and office sectors reported a higher delinquency rate, while all other property types reported lower or unchanged rates. Fitch noted it anticipates the delinquency rate will not likely fall below 1.75% by year-end.

For 2023, Fitch forecast its U.S. CMBS loan delinquency rate will increase significantly to between 4.0% and 4.5% by year-end “as higher interest rates, persistent inflation and weak economic growth contribute to more maturity defaults. Fitch expects the U.S. economy to enter a mild recession in mid-2023,” it said.

Fitch said it expects higher delinquency rates across property sectors next year. “Retail and hotel rates, which are the highest across all property types, will increase further, and multifamily, office and industrial rates will exceed their pandemic peaks,” the report said.

Fitch forecasts substantially more new delinquencies–especially maturity defaults–next year, and said special servicing resolutions will likely slow due to elevated refinancing costs and pressure on commercial real estate fundamentals and capitalization rates. New issuance volume and property type compositions will likely remain consistent with 2022 levels, the report said. The delinquency rate will become more volatile next year, particularly during the first half of 2023, but it should remain below the 4.98% pandemic peak.

“While Fitch expects maturity defaults to drive special servicing volume in 2023, defaults may be temporary as special servicers evaluate potential loan extensions against sponsor strength and equity,” the report noted.