CMBS Delinquency Rate Rises

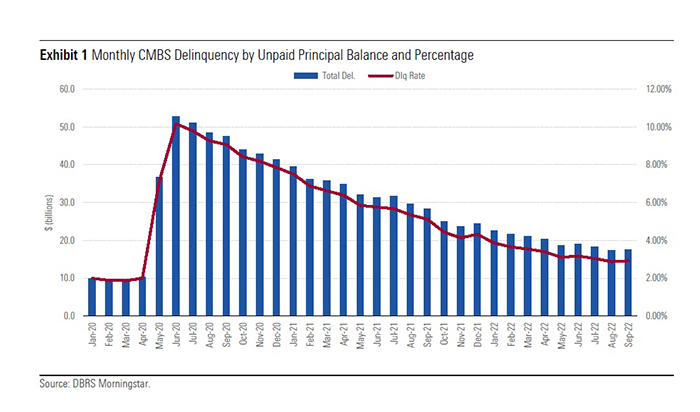

DBRS Morningstar, New York, said the delinquency rate for loans packaged in commercial mortgage-backed securities rose in September for just the third time since mid-2020.

The CMBS delinquency rate increased four basis points to 2.92%, DBRS said in its September Remittance report.

Retail and office assets drove the delinquency rate higher with 19 and 10 basis point increases, respectively, while the hotel sector posted a 14-basis-point delinquency rate decline from August to 4.86%.

“Except for a minor uptick this month and two rare upticks over the past 24 months, [the delinquency rate] continues to decline despite market turbulence, rising interest rates and slowing growth,” DBRS said. “With property market fundamentals generally solid, the delinquency rate is likely to continue falling as inflation and capital-markets turmoil abate.”

DBRS noted the CMBS special servicing rate increased for the second consecutive month in September, by nine basis points to 5.17% after falling for 22 consecutive months. Loans with a total outstanding balance approaching $1.2 billion transferred to the special servicer.

“Special servicing transfer volume continued to outpace loans sent to the master servicer for the second consecutive month, with the highest in the last 12 months seen in August,” the report said. “Office loans formed the bulk of the transferred loans.”

Distressed property sales remained “muted” in September, DBRS said. Liquidation activity fell to just over $200 million from more than $300 million in August, well below the $284 million 12-month moving average.

Looking at CMBS rating actions, Fitch Ratings, New York, reported affirmations and rating outlook revisions to stable dominated CMBS rating actions in the third quarter. “There were also fewer downgrades, and a lower percentage of ratings with negative outlooks, the latter now approaching near pre-pandemic levels,” Fitch said in a non-rating commentary.

“While Fitch’s North America CMBS ratings are well positioned and property performance and cash flows continue to stabilize from their pandemic lows, growing macroeconomic concerns including rising interest rates, high inflation, slowing economic growth and the prospect of the U.S. entering a mild recession in mid-2023 are increasing the downside risks and CMBS asset performance may deteriorate in 2023, slowing the post-pandemic recovery,” Fitch said.

Most downgrades this year came from higher loss expectations on lower-tier regional mall exposures with performance deterioration and/or increased refinance concerns as well as specially serviced loans whose assets have additional valuation declines, worsening performance or an expected prolonged workout, Fitch noted.