NEWS FOR YOU

FHFA Announces 2023 Multifamily Loan Purchase Caps for Fannie Mae, Freddie Mac; See Today's MBA Advocacy Update for Details

On Friday, the Federal Housing Finance Agency announced 2023 multifamily loan purchase caps for Fannie Mae and Freddie Mac will be $75 billion for each Enterprise (for a total of $150 billion). FHFA maintained the requirement that 50 percent of the Enterprises’ business must be for mission-driven affordable housing and added a new mission-driven category for workforce housing properties.

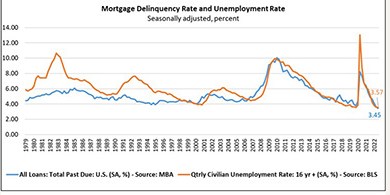

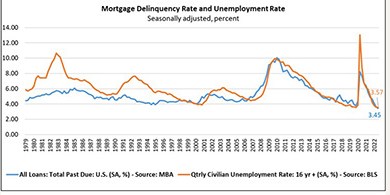

The Mortgage Bankers Association on Thursday released its 3rd Quarter National Delinquency Survey, reporting delinquency rate for mortgage loans on one-to-four-unit residential properties fell to its lowest level since the Survey’s inception.

Colliers International, Toronto, said the U.S. office market is stabilizing following two-plus years of pandemic-driven correction, but noted “considerable debate and speculation” about its future.

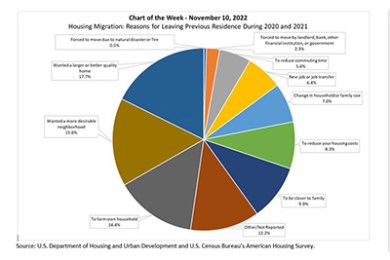

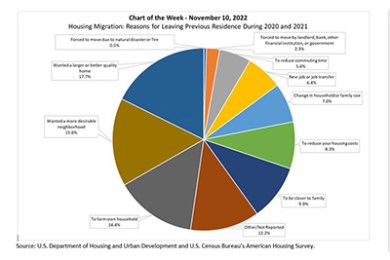

This week’s MBA Chart of the Week shows the reasons for leaving one’s previous residence. The three main reasons in the 2021 AHS are wanting a larger or better-quality home (17.7%), wanting a more desirable neighborhood (15.6%) and forming their own household (14.4%).

JLL Capital Markets’ Denver office arranged $172 million in financing for acquisition of the newly completed Four Seasons Hotel Nashville.

Using telco, pay TV and utilities insights to help create greater homeownership opportunities for millions of U.S. mortgage applicants.

There’s been a lot of research done on the impact Millennials and single women are having on the housing market. Yet there’s not a lot of solid advice on how to attract and engage these audiences, which is a shame considering how important they are to an originator’s business. But there are effective ways to get your message across if you’re willing to rethink your current marketing strategy.

Why does innovation and technology ROIs continue to disappoint? ROI efficacy has become the symptom of the problem as the bullseye of measure is no longer fixed on the application, the cloud solution, or the innovation delivered. The rise of digital ecosystems has permanently altered the ROI discussions and evaluations—and the investment strategies deployed.

A few mortgage executives are embracing a more holistic strategy that goes beyond these all-too-familiar and destructive tactics—cost transformation. But what is it, exactly? More importantly, how can it help lenders operate more efficiently regardless of market shifts?

What follows are the findings of a semi-annual survey of senior mortgage banking executives. The surveys, which were conducted in mid-October, were of mortgage veterans at 33 different mortgage companies -- 17 financial intermediaries, largely commercial banks; and 16 non-banks, independent mortgage banks or IMBs.

So, I headed to Nashville for the 2022 MBA Annual Convention and Expo, expecting to fully partake in all the excitement that Music City has to offer. Mission accomplished, but not surprised to also witness the build-up to the industry’s looming game of musical chairs.