Mark P. Dangelo: Data Ecosystems and Fabrics are the New ROI—Not Systems

Mark P. Dangelo is Chief Innovation Officer with Innovation Expertus, Cleveland, Ohio, responsible for leading and managing global experiential teams for business transformations, digital projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of five innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

Return on investment (#ROI) has been a foundational key performance indicator (#KPI) surrounding innovation and technology for decades. Now with corporate pressures on reducing costs and the demands to find additional revenue sources, the pressure on making the most of technology or innovational investments has not been this unmistakable since the Great Recession.

There are many methods to define ROI, as it is governed by the granularity of its composition (i.e., ROI is often an aggregation or determination of many discrete elements captured over time periods) and the organizational measures deemed important matched against goals and objectives. But is the efficacy of innovation, application, and system ROI’s common during the last two decades providing the leadership and operating criteria needed to distinctively compete? That is, does ROI have relevancy in an industry awash in data, metadata, and federated digital offerings?

As industry leaders we are facing considerable consumer uncertainty and market chaos calling into question ROI benchmarks that worked when volumes were high and interest rates were low. Or should we recognize that unfamiliar and behavioral operational methods now necessary to compete require corresponding shifts in how we evaluate technology, focus on solution outcomes, and deal with cycle times measured in weeks and months—not years?

Shifting the Focus and Composition of ROI

While foundational, ROI application and relevancy has been difficult to assess even when organizations are deploying similar solutions sets and operating parameters. Why? Is the inability to achieve ROI for solutions due to organizational culture challenges? What about poor execution or mismatched requirements? Still, others point to ROI failures attributable to ecosystem changes, miscommunications and overreaching expectations, organizational change and skill voids, and even cast shadows on the customers or partners for their inability to “understand.”

Reinforcing the validity of using ROI KPI’s derived by system solutions as the center of the measurement bullseye, was a reoccurring question at the recent MBA 2022 Annual convention in Nashville. While vendor solutions promote significant returns and benefits of implementation, the reality of ROI operational returns are more elusive, but why? Perhaps the rationale for legacy ROI failures is anchored in the reality of implementing complex applications within fragmented organizational business units? Perhaps ROI KPI’s were improperly defined, measured, or reported? Perhaps, just perhaps, ROI measurements against the traditional solutions of technology and legacy processes are simply measuring returns on analytics that have shifted—no longer are the top priority indicators of efficiency?

A critical data point supporting shifts of priority is the proliferation of AI (artificial intelligence) and ML (machine language) across the finance and mortgage industries. These advanced, stage-gate solutions elevate the importance of data—not systems—to (re)train analytical and predictive capabilities against natively digital consumers and their shifting behaviors. AI and ML require the leverage of vast digital assets to eliminate bias and deliver accuracy (see @IBM, AI Model Lifecycle Management). Factor in the lifespan of AI and ML solutions measured in months—impacted by the six V’s of digital which addresses volume, veracity, validity, value, validation, and variability—and the ROI of technology and innovational adoption move into secondary considerations when compared to the relative value of centralized versus decentralized digital assets (see @McKinsey, The AI Bank of the Future).

A few months ago to further reinforce this ROI transformation, I wrote two articles (i.e., Paradigm Shift: Data is the Material Value—Systems are Just Enablers, and from the MBA Annual 2022 Show Guide, “Adapt or Die: Customers for Life Demand a Comprehensive Digital Experience) discussing shifting strategies, digital monetization, and immutability of layered, decentralized data assets. In short, the applicability of technology ROI are now second tier considerations when it examined in context to the material, lasting results of digital transformation.

Digital transformation and the ROI analytics that started their roadmaps were measuring improvements against legacy, paper-based processes and mindsets that were digitally codified and automated—not digitally native (and using methods like 6-Sigma to eliminate waste and focus on reusable, trusted digital assets).

Today after a decade of continuous automation and transformation initiatives, forward looking financial industry leaders have accepted that the first tier of ROI is about digital valuations, data governance and curation, and decentralized data leverage from trusted systems of record (#SoR). Indeed, systems and their process efficiencies have now become enablers for digital integrations and data reuse theoretically driving costs to zero. This shifting reality and business model impacts are a pronounced shift for an industry comprised of nearly 4,000 lenders with the largest having no more than a 12% market share.

In summary, the extensive and reoccurring initiatives focused on digital transformation (estimated to exceed $2 trillion per year in 2022) have permanently shifted ROI discussions due to the imperatives of digital trust, data sovereignty, and most importantly, data reusability (which drives costs down and delivers efficiencies across the mortgage supply chain). ROI of data, often viewed under the umbrella of digital monetization, has been calculated underneath system capabilities and functionality of the solutions deployed.

ROI is NOT About a Repetitive Technology Prescription—or Mindset

With the rapid proliferation of cloud computing solutions and the ability to integrate vast data sources, we can now recognize that “digital fabrics” linking elements across application infrastructures takes on critical importance beyond the legacy data practices of #ETL (extract, transform, and load). For bankers seeking a prescriptive differentiator, the ROI one-size fits all model using common vendor solutions as a competitive advantage is ending at the worst possible time—rising rates, declining volumes, and margins measures in negatives per loan. For leaders seeking survivable opportunities, what is next and how should it be measured? Let look at possible journey map potentials.

As I walked the exhibition floor at MBA 2022 Annual conference, what I continued to see and discuss were vendors seeking to incrementally improve their solutions across the vertical functions they targeted. Additionally, their participation across a digital product development fabric of reusable data that singularly meets customer, banking, regulatory, secondary and investor utilization, was an afterthought to the functional solution being sold.

Is it unsuitable to focus on efficiency improvement leveraging legacy measurements? No. Are there greater returns possible when using industry standards to create a digital fabric that cut across system platforms and bounded data stores? Yes. Is anyone working on the “next” iteration of mortgage solutions that transcends functional system boundaries using cross-platform digital fabrics? This is the unknown and the speculation a few of us have when it comes to the post-deal, digital impacts of recent M&A actions (e.g., @ICE).

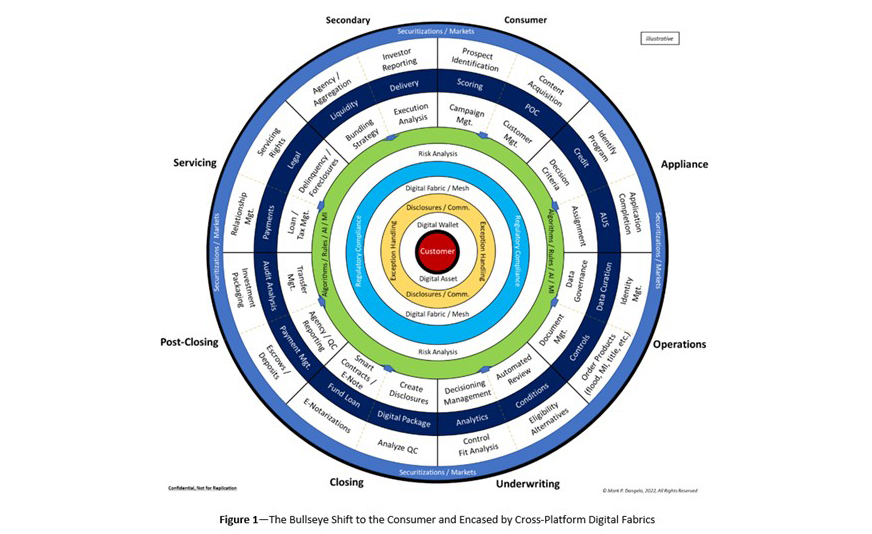

When you reimage the mortgage processing supply chain (i.e., adopting a supply chain approach) by starting with the customer at one end and the investor at the other, then the middle processes and reusable requirements deliver a focus on digital monetization that was previously a second-tier priority surrounding implementation outcomes (see Figure 1).

For those bankers and vendors concerned about the future, the digital strategy being defined is clearly projecting data as the ROI priority with systems contributing to the digital fabrics linked from end-to-end (see How to Succeed in the Mortgage Industry 2022-2026, 2nd Gen Partners, “Adapt or Die: The Mortgage Technology Ecosystem Reimaged for the Digital Consumer”). Explicitly, the adoption and adaptation of digital fabrics for a mortgage technology supply chain (with systems enabling its execution) consistently delivers reusability, recoverability, origin immutability, cross-platform digital profiles, accuracy and consistency, reduction of regulatory compliance costs, and digital customer for life capabilities that can be extended to emerging areas such as virtual and augmented reality.

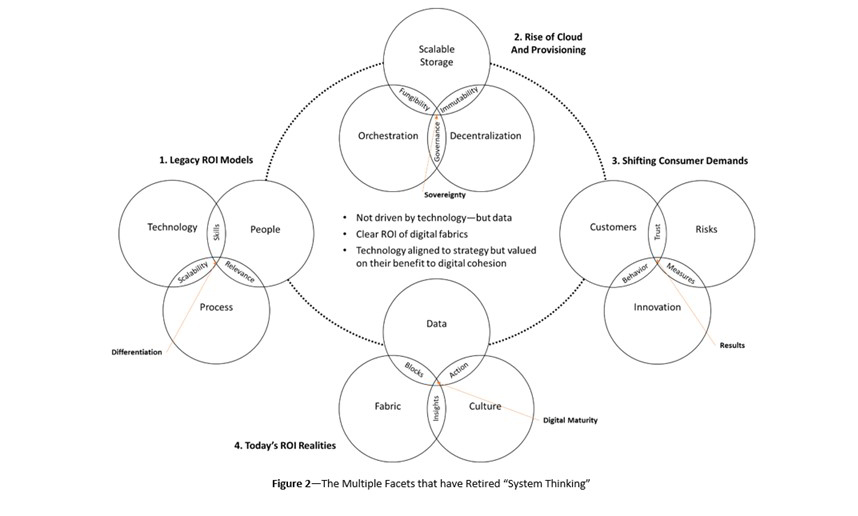

The ROI of digital represents both the familiar and the unfamiliar for financial services leaders. Before the rise of cloud computing and the explosion of data volumes (every 2.2 years we capture more digital data than in all human history previously recorded), centralization and rehoming of digital documents as assets were the models of implementation. These explosions ushered in over the last seven years an umbrella of disciplines and solutions now loosely called data sciences. The result is where we are today—at the step-function capability to move the bullseye from applications and technology to data ecosystems.

As other industries embrace the realities and benefits of consumers conducting their lives within data ecosystems, financial services leaders must now accept that their mindsets of controlling data and rehoming it into their centralized (albeit cloud-based solutions) does not represent a viable, economically efficient business model. Moreover, the metadata for the mortgage process now exceeds the data used in the loan process.

Couple this with innovation technologies like blockchain, digital wallets, digital-only investor instruments, and the landscape of how ROIs were calculated against the automation of paper-based data elements and processes, we can understand why legacy ROI and the bullseye obsession with system solutions are quickly ending. ROI is now facing this unfamiliar, digital fabric step-function (see transitionary stages and categories within Figure 2).

In summary, the shifting of ROI elements for many organizations and individuals within the financial services and mortgage industries represents a phase shift of importance, analysis, and differentiation. However, as the cycle times for our innovations are shortened, our competitors match our offering and then exceed it, consumers demanding shorter timeframes and reduced costs, regulators codifying granular demands and reporting that cuts into margins, and investors looking for derisked loans and greater information, the complexity of approaches and vertical solution workarounds cannot be maintained.

In the end, ROI efficacy has become the symptom of the problem. The problem firmly resides with the fundamental and permanent shift to the digital ecosystems and the fabrics that define a profitable path forward. It just remains to be seen, who will illuminate the path forward and set the industry firmly onto the next curve of growth.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)