MBA: 3Q Mortgage Delinquencies Fall to New Survey Low

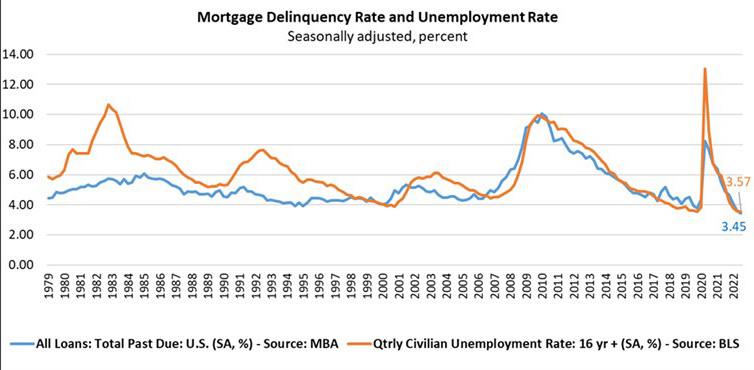

The Mortgage Bankers Association on Thursday released its 3rd Quarter National Delinquency Survey, reporting delinquency rate for mortgage loans on one-to-four-unit residential properties fell to its lowest level since the Survey’s inception.

The survey said mortgage delinquencies fell to a seasonally adjusted rate of 3.45 percent of all loans outstanding at the end of the third quarter. By stage, the 30-day delinquency rate remained unchanged at 1.66 percent; the 60-day delinquency rate increased 4 basis points to 0.53 percent; and the 90-day delinquency bucket decreased 22 basis points to 1.27 percent.

Loans in the foreclosure process at the end of the third quarter fell to 0.56 percent, down 3 basis points from the second quarter, but 10 basis points higher than one year ago.

For purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage. The delinquency rate fell by 19 basis points from the second quarter and by 143 basis points from one year ago.

“For the second quarter in a row, the mortgage delinquency rate fell to its lowest level since MBA’s survey began in 1979,” said Marina Walsh, CMB, MBA Vice President of Industry Analysis. “Foreclosure starts and loans in the process of foreclosure also dropped in the third quarter to levels further below their historical averages. The relatively small number of seriously delinquent homeowners are working with their mortgage servicers to find foreclosure alternatives, including loan workouts that allow for home retention.”

MBA’s latest forecast calls for a recession in the first half of 2023, driven by tighter financial conditions, reduced business investment and slower global growth. As a result, the unemployment rate is expected to reach 5.5 percent by the end of next year, nearly 200 basis points higher than the estimated 3.7 percent rate in October.

“The delinquency rate will likely increase in upcoming quarters from its current record low because of both the anticipated uptick in unemployment and the effect of natural disasters such asHurricane Ian in Florida, South Carolina, and other states, which will likely result in an increase in forbearance agreements to allow impacted homeowners to get back on their feet,” Walsh said.

Key findings of MBA’s Third Quarter National Delinquency Survey:

- From the second quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding to 3.45 percent, the lowest level in the history of the survey dating back to 1979. By stage, the 30-day delinquency rate remained unchanged at 1.66 percent, the 60-day delinquency rate increased 4 basis points to 0.53 percent, and the 90-day delinquency bucket decreased 22 basis points to 1.27 percent.

- By loan type, the total delinquency rate for conventional loans decreased by 12 basis points from the previous quarter to 2.52 percent. The FHA delinquency rate decreased by 33 basis points to 8.52 percent, while the VA delinquency rate decreased by 51 basis points to 3.71 percent.

- On a year-over-year basis, total mortgage delinquencies decreased for all loans outstanding. The delinquency rate decreased by 103 basis points for conventional loans, by 282 basis points for FHA loans, and by 210 basis points for VA loans.

- The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. For much of the past two years, foreclosure moratoria were in place, which kept these numbers artificially low.

- The percentage of loans in the foreclosure process at the end of the third quarter fell to 0.56 percent, down 3 basis points from the second quarter, but 10 basis points higher than one year ago.

- The percentage of loans on which foreclosure actions were started in the third quarter fell by 3 basis points to 0.15 percent.

- The non-seasonally adjusted seriously delinquent rate (the percentage of loans that are 90 days or more past due or in the process of foreclosure) fell to 1.90 percent, down by 22 basis points from second quarter and by 150 basis points from one year ago. The seriously delinquent rate decreased by 18 basis points for conventional loans, by 38 basis points for FHA loans and by 32 basis points for VA loans. From a year ago, the seriously delinquent rate decreased by 96 basis points for conventional loans, by 393 basis points for FHA loans and by 197 basis points for VA loans.

States with the largest quarterly decreases in their overall delinquency rate were: Alaska (102 basis points), Hawaii (32 basis points), Maine (31 basis points), Rhode Island (29 basis points) and Connecticut (29 basis points).