Ahead of MBA Quarterly Survey, Reports Show Drop in Delinquencies, Rise in Foreclosures

This morning, the Mortgage Bankers Association releases its 3rd Quarter National Delinquency Survey. Ahead of the report, CoreLogic, Irvine, Calif., reported steady drops in mortgage delinquencies in August, while ATTOM, Irvine, Calif., said the end of foreclosure moratoria earlier this summer is pushing mortgage foreclosure actions higher.

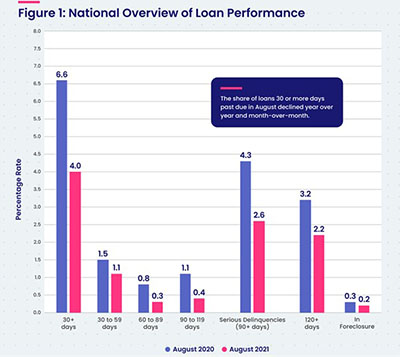

CoreLogic released its monthly Loan Performance Insights Report for August, showing 4% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), a 2.6-percentage point decrease in delinquency from a year ago, when it was 6.6%.

The report said Early-Stage Delinquencies (30 to 59 days past due) fell to 1.1%, down from 1.5% a year ago. Adverse Delinquencies (60 to 89 days past due) fell to 0.3%, down from 0.8% in August 2020. Serious Delinquencies (90 days or more past due, including loans in foreclosure) fell to 2.6%, down from 4.3% a year ago.

The report also noted the Foreclosure Inventory Rate fell to 0.2%, down from 0.3% a year ago, tying the lowest foreclosure rate recorded since CoreLogic began recording data (1999). The Transition Rate (the share of mortgages that transitioned from current to 30 days past due) fell to 0.6%, down from 0.9% in August 2020.

CoreLogic said households, facing slower than anticipated employment growth — August saw an increase of only 235,000 new jobs compared to the expected 720,000 —have found creative ways to cut back on spending to prioritize mortgage payments. A recent CoreLogic survey found more than 30% of respondents said they would cut back on both entertainment and travel to focus on repaying outstanding debt.

“The unprecedented fiscal and monetary stimuli that have been implemented to combat the pandemic are pushing housing prices and home equity to record levels,” said Frank Martell, president and CEO of CoreLogic. “This phenomenon is driving down delinquencies and fueling a boom in cash-out refinancing transactions.”

“The decline in the overall delinquency rate to its lowest since the onset of the pandemic is good news, but it masks the serious financial challenges that some of the borrower population has experienced,” said Frank Nothaft, chief economist at CoreLogic. “In the months prior to the pandemic, only one-in-five delinquent loans had missed six or more payments. This August, one-in-two borrowers with missed payments were behind six-or-more monthly installments, even though the overall delinquency rate had declined to the lowest level since March 2020.”

The report said all states saw year over year declines in their overall delinquency rate. New Jersey (down 4.0 percentage points); Florida (down 3.8 percentage points); and Nevada (down 3.6 percentage points), saw the largest year over year declines. All other states experienced decreases between -1.3 and -3.3 percentage points.

Additionally, the report said all U.S. metropolitan areas posted at least a small annual decrease in their overall delinquency rate. The largest annual decreases were in Laredo, Texas (down 6.3 percentage points), Miami-Fort Lauderdale-Pompano Beach, Fla. (down 5.7 percentage points), McAllen-Edinburg-Mission, Texas (down 5.3 percentage points) and Atlantic City-Hammonton, N.J. (down 5 percentage points).

Meanwhile, ATTOM’s October U.S. Foreclosure Market Report said 20,587 properties had foreclosure filings, up by 5 percent from September and by 76 percent from a year ago.

“As expected, now that the moratorium has been over for three months, foreclosure activity continues to increase,” said Rick Sharga, executive vice president of ATTOM subsidiary RealtyTrac. “But it’s increasing at a slower rate, and it appears that most of the activity is primarily on vacant and abandoned properties, or loans that were in foreclosure prior to the pandemic.”

The report said one in every 6,675 housing units had a foreclosure filing in October. States with the highest foreclosure rates were Illinois (one in every 1,923 housing units); Florida (one in every 3,180 housing units); New Jersey (one in every 3,438 housing units); Nevada (one in every 3,837 housing units); and Ohio (one in every 4,386 housing units). Among the 220 metropolitan statistical areas, those with the highest foreclosure rates in October were St. Louis (one in every 1,138 housing units); Trenton, N.J. (one in every 1,293 housing units); Miami (one in every 2,233 housing units); Chicago (one in every 2,284 housing units); and Cleveland (one in every 2,285 housing units).

Other report findings:

–Lenders started the foreclosure process on 10,759 U.S. properties in October, up 5 percent from last month and up 115 percent from a year ago.

“Most foreclosure activity for the next few months is likely to be foreclosure starts,” Sharga said, “since virtually nothing entered the foreclosure process during the past year. The ratio of foreclosure starts to foreclosure completions will normalize over time as we get back to normal levels of activity.”

–Lenders repossessed 3,027 U.S. properties through completed foreclosures (REOs) in October, up 13 percent from last month and up 17 percent from last year.

This morning, MBA releases its Third Quarter National Delinquency Survey, which covers 38 million loans on one- to four- unit residential properties. Loans surveyed are reported by more than 100 servicers, including independent mortgage companies and depositories such as large banks, community banks and credit unions.

MBA Vice President of Industry Analysis Marina Walsh, CMB, will provide commentary and analysis. Look for a special edition of MBA NewsLink late Wednesday morning to cover NDS results.