BREAKING NEWS

Refis Jump in MBA Weekly Applications Survey

Mortgage rates fell for the second straight week, triggering a jump in refinance activity, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending November 5.

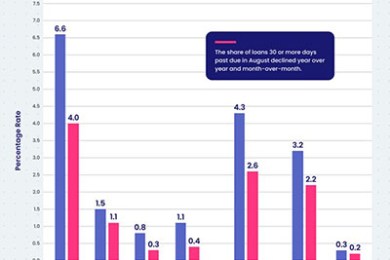

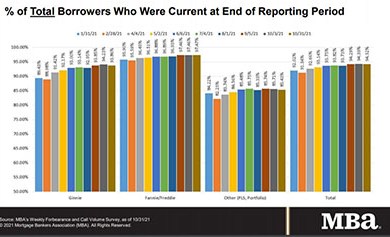

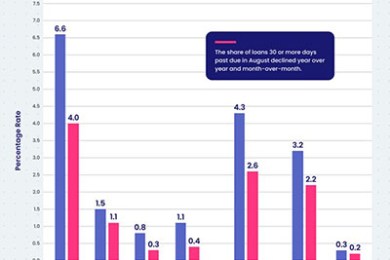

This morning, the Mortgage Bankers Association releases its 3rd Quarter National Delinquency Survey. Ahead of the report, CoreLogic, Irvine, Calif., reported steady drops in mortgage delinquencies in August, while ATTOM, Irvine, Calif., said the end of foreclosure moratoria earlier this summer is pushing mortgage foreclosure actions higher.

The supply of single-family lots ready for homebuilders to build on fell to a new low in the third quarter, reported Zonda, Newport Beach, Calif.

Fitch Ratings, New York, said it sees limited risks to real estate investment trust credit fundamentals from a transitory inflation-rate increase, but noted prolonged elevated inflation could pressure REITs.

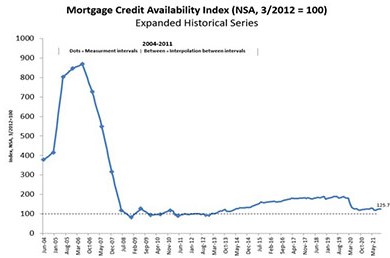

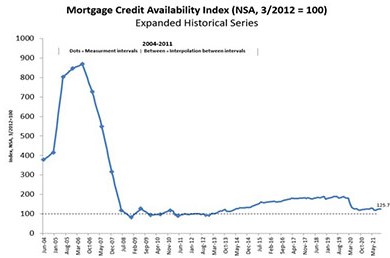

Mortgage credit availability increased for the fourth straight month in October, albeit ever so slightly, the Mortgage Bankers Association reported Tuesday.

Wipro Opus Risk Solutions LLC, Lincolnshire, Ill., appointed Kebra Rhedrick as Chief Compliance Counsel.

Machine Investment Group, New York, acquired 1010 Rincon Circle in Silicon Valley’s North San Jose submarket for $32.6 million.

The time to effectively transform our analysis of all things digital is being reduced from months to days. The revolution and rapid embrace of low-code/no-code solutions by giant Walmart will set off multiple tangential strategies to influence the consumer—all in the hands of newly empowered, front-line domain experts.

It’s time to make a decision. What will you be doing in 2022? If you’re in the mortgage industry and you think you’ll still be in the business next year, there’s a good chance you’re wrong. The business will shrink next year and many who are working here now won’t be here by the end of the year.

Lenders should consider examining existing or new service providers for critical services (title, appraisal or other elements of the mortgage process that would be difficult to produce in-house, but without which, a purchase mortgage transaction simply cannot take place) much as they would their own, internal cost centers.

MBA Newslink interviewed Katelynn Harris Walker, Associate Director of Affordable Housing Initiatives for the Mortgage Bankers Association, where she is dedicated full time to advocacy and engagement on affordability.

In early October I surveyed 34 senior executives from 34 separate mortgage companies about an array of issues and topics both relevant and consequential to the mortgage banking industry. It was the 26th time since 2008 that this survey has been conducted and published by the MBA.

The Mortgage Bankers Association’s Independent Mortgage Bankers Conference 2022 takes place Jan. 24-27 in Nashville, Tenn.