WASHINGTON–The Mortgage Bankers Association presented its annual Burton C. Wood Legislative Service Award to Owen Lee, CEO of Success Mortgage Partners, Plymouth, Mich.

Tag: Frank Martell

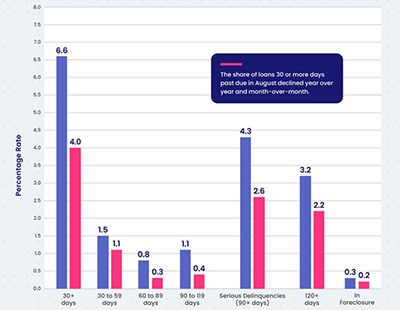

CoreLogic: Mortgage Delinquencies at Pre-Pandemic Low

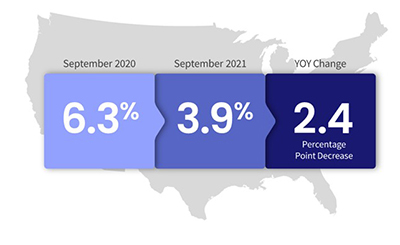

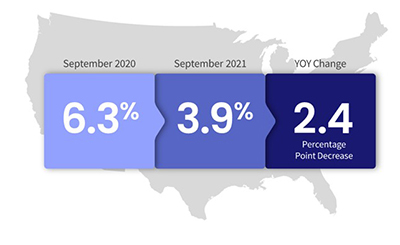

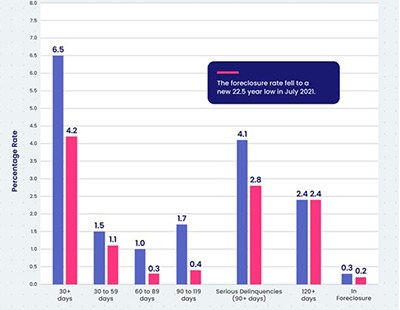

CoreLogic, Irvine, Calif., reported the nation’s overall delinquency rate declined for seventh consecutive month to its lowest level since the start of the coronavirus pandemic.

CoreLogic: Mortgage Delinquencies at Pre-Pandemic Low

CoreLogic, Irvine, Calif., reported the nation’s overall delinquency rate declined for seventh consecutive month to its lowest level since the start of the coronavirus pandemic.

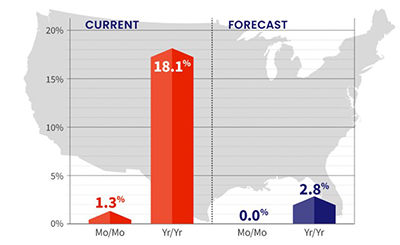

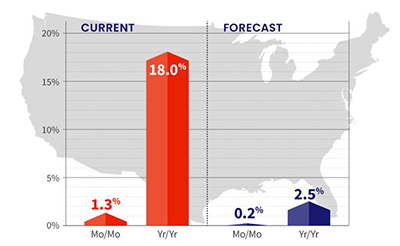

CoreLogic: Annual Home Price Appreciation Up 18.1%

While several recent reports suggest home price appreciation is decelerating, CoreLogic, Irvine, Calif., says the home-selling gravy train isn’t ending anytime soon.

Mortgage Delinquency Declines Approach Pre-Pandemic Levels

As home equity continues to soar, mortgage delinquency rates fell to levels not seen since onset of the coronavirus pandemic, said CoreLogic, Irvine, Calif.

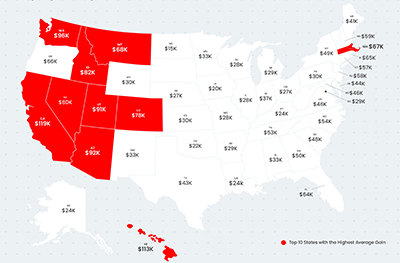

CoreLogic: Homeowners Gained $3.2 Trillion in Equity in Q3

CoreLogic, Irvine, Calif., said homeowners with mortgages (which account for 63% of all properties) saw their equity increase by 31.1% year over year in the third quarter, representing a collective equity gain of more $3.2 trillion and an average gain of $56,700 per borrower.

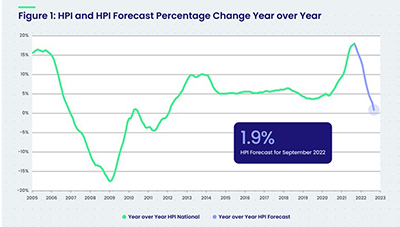

CoreLogic: Annual Home Price Growth at Record 18%

CoreLogic, Irvine, Calif., said annual home price growth remained strong at 18% in October, the highest recorded in the 45-year history of its monthly Home Price Index.

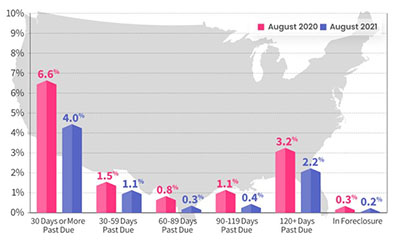

Ahead of MBA Quarterly Survey, Reports Show Drop in Delinquencies, Rise in Foreclosures

This morning, the Mortgage Bankers Association releases its 3rd Quarter National Delinquency Survey. Ahead of the report, CoreLogic, Irvine, Calif., reported steady drops in mortgage delinquencies in August, while ATTOM, Irvine, Calif., said the end of foreclosure moratoria earlier this summer is pushing mortgage foreclosure actions higher.

CoreLogic: Annual Home Price Growth Hits 18% in September as Supply/Demand Imbalances Intensify

Demand for homebuying remained strong in September, said CoreLogic, Irvine, Calif., with limited housing supply creating challenges for those looking for homes.

CoreLogic: Delinquency Rates Approach Pre-Pandemic Levels

CoreLogic, Irvine, Calif., said delinquency rates on all mortgages in the U.S. fell in July to the lowest rates since March, edging closer to pre-pandemic levels.