While overall mortgage delinquencies were relatively flat compared to last year, earlier-stage delinquencies declined while serious delinquencies – those loans 90 or more days delinquent or in foreclosure – increased.

Tag: MBA National Delinquency Survey

Mortgage Delinquencies Increase in Fourth-Quarter 2024

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.98% of all loans outstanding at the end of the fourth quarter, according to MBA’s National Delinquency Survey.

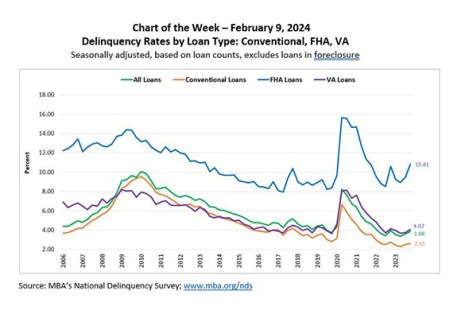

MBA Chart of the Week: Delinquency Rates by Loan Type

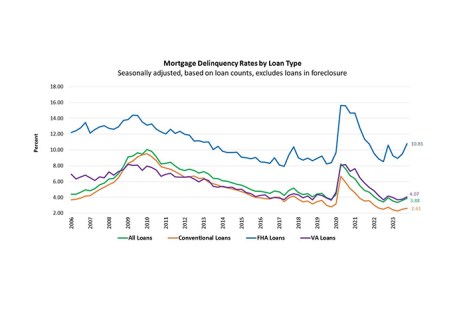

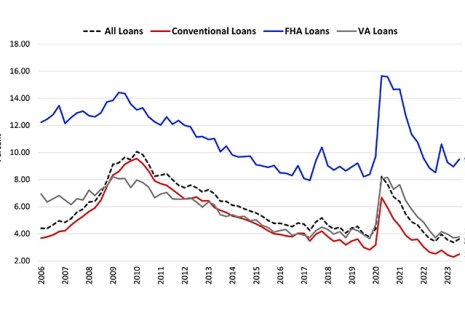

According to the latest MBA National Delinquency Survey, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to a seasonally adjusted rate of 3.88 percent of all loans outstanding at the end of the fourth quarter.

MBA: Mortgage Delinquencies Increase in the Fourth Quarter of 2023

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.88% of all loans outstanding at the end of the fourth quarter of 2023, according to the Mortgage Bankers Association’s National Delinquency Survey.

MBA Chart of the Week: Delinquency Rates by Loan Type, Conventional, FHA, VA

According to the latest MBA National Delinquency Survey, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to 3.62 percent of all loans outstanding at the end of the third quarter of 2023.

MBA: Mortgage Delinquencies Decrease in Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.37 percent of all loans outstanding at the end of the second quarter, according to the Mortgage Bankers Association’s National Delinquency Survey.

MBA: Mortgage Delinquencies Decrease in Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.37 percent of all loans outstanding at the end of the second quarter, according to the Mortgage Bankers Association’s National Delinquency Survey.

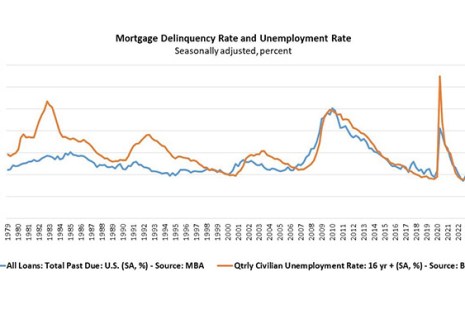

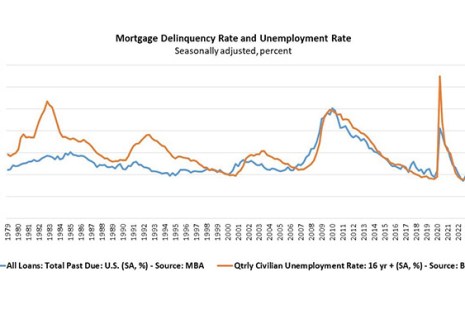

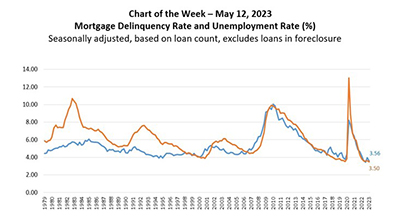

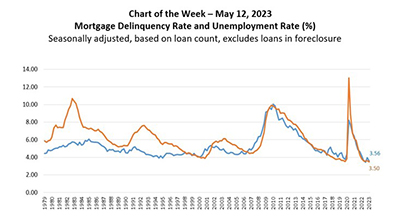

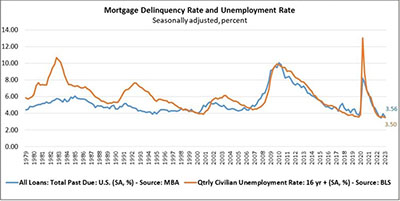

MBA Chart of the Week May 12, 2023: Mortgage Delinquency Rate, Unemployment Rate

This week’s chart shows that mortgage delinquencies and the unemployment rate continue to track each other closely.

MBA Chart of the Week May 12, 2023: Mortgage Delinquency Rate, Unemployment Rate

This week’s chart shows that mortgage delinquencies and the unemployment rate continue to track each other closely.

MBA: 1Q Mortgage Delinquency Rates Near Historic Lows

Mortgage delinquency rates fell to near-historic lows in the first quarter, the Mortgage Bankers Association reported Thursday.