BREAKING NEWS

Loans in Forbearance Fall to 2.06%; October MBA Mortgage Credit Availability Index Inches Up

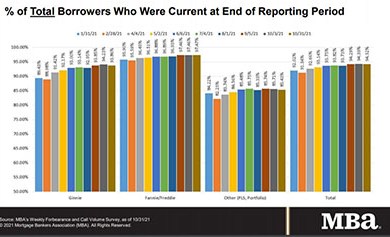

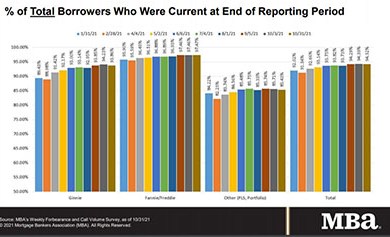

The Mortgage Bankers Association issued its final Forbearance and Call Volume Survey on Monday; 77 weeks after its first survey, MBA reported one million homeowners in forbearance plans, down from more than six million in mid-2020.

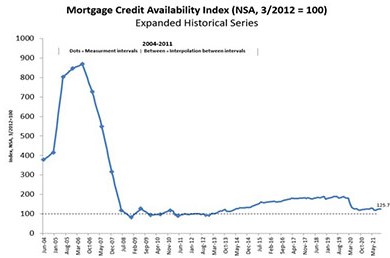

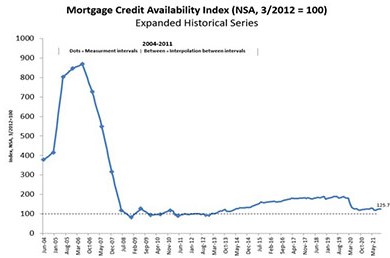

Mortgage credit availability increased for the fourth straight month in October, albeit ever so slightly, the Mortgage Bankers Association reported Tuesday.

We’re starting to get a lot of year-end housing market reports—which means we should be soon getting 2022 forecasts. Here is a roundup of recent reports to come across the MBA NewsLink desk:

Investors are following shoppers as they return to lifestyle centers, said JLL, Chicago.

It’s time to make a decision. What will you be doing in 2022? If you’re in the mortgage industry and you think you’ll still be in the business next year, there’s a good chance you’re wrong. The business will shrink next year and many who are working here now won’t be here by the end of the year.

Walker & Dunlop, Bethesda, Md., completed the $134 million sale of Griffis Marston Lake, a 332-unit Littleton, Colo. multifamily community.

This week’s MBA Chart of the Week examines the growth rates of single-family construction and residential construction workers since the trough in home building activity in April 2020.

Lenders should consider examining existing or new service providers for critical services (title, appraisal or other elements of the mortgage process that would be difficult to produce in-house, but without which, a purchase mortgage transaction simply cannot take place) much as they would their own, internal cost centers.

MBA Newslink interviewed Katelynn Harris Walker, Associate Director of Affordable Housing Initiatives for the Mortgage Bankers Association, where she is dedicated full time to advocacy and engagement on affordability.

In early October I surveyed 34 senior executives from 34 separate mortgage companies about an array of issues and topics both relevant and consequential to the mortgage banking industry. It was the 26th time since 2008 that this survey has been conducted and published by the MBA.

While Rural Development's requirements lack details specific to the content of the security instruments used, they do have plenty of other requirements regarding the servicing of a loan which may not be completely compatible with the covenants within the SIs. The following summarizes the types of conflicts, additional requirements and near conflicts that may exist

The Mortgage Bankers Association's Commercial Real Estate Finance/Multifamily Housing Convention & Expo takes place Feb. 13-16 at the Manchester Grand Hyatt in San Diego.