MBA Chart of the Week: Missed Payments By Month (Q2-Q3)

This week’s MBA Chart of the Week chart provides fresh third quarter 2020 insights on the Research Institute for Housing America’s special report released in September that highlighted household financial distress during the second quarter—the first three months of the pandemic.

The study, authored by Gary Engelhardt of Syracuse University and Mike Eriksen of the University of Cincinnati, used innovative household panel survey data from the Understanding America Study, an internet panel survey of more than 8,000 households specially tailored to study the impact of the pandemic.

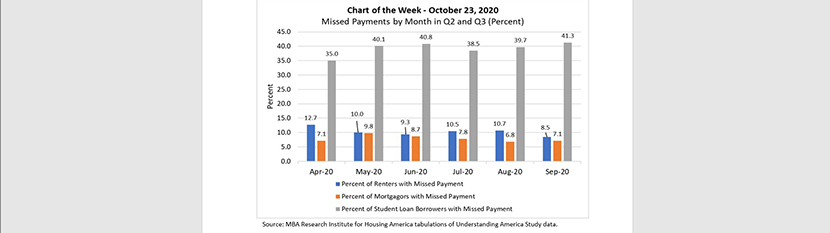

Updated analysis of UAS data through the end of September, summarized in MBA’s press release released last week, shows how renters, mortgagors and student loan borrowers fared over the summer.

The downward trend of the proportion of renters that missed payments in the second quarter reversed in July and reached 10.7 percent in August. This coincided with the CARES Act’s $600 weekly enhancement to unemployment benefits ending on July 31. Despite the payment expiration,, the percent of missed rent payments fell to a six-month low in September (8.5%), with 2.82 million renter households not making their rent payments.

The proportion of mortgagors with missed payments was lower in the third quarter than the second quarter. However, missed mortgage payments in the third quarter still represent $19.4 billion, a significant portion of borrowers.

According to the study, the proportion of student debt borrowers who missed a monthly payment has remained steady since May at around 40 percent. Student loan borrowers are more likely to have missed a rent or mortgage payment in the last six months (e.g., 10 percent of non-student loan borrower mortgagors have missed a mortgage payment since March, whereas over 20 percent of student loan borrower mortgagors have done so).

With more than 34 million student loan borrowers having missed payments in the second and third quarters, it’s worth watching if there will be auxiliary consequences for the housing and mortgage markets in the coming months.

—Edward Seiler eseiler@mba.org.