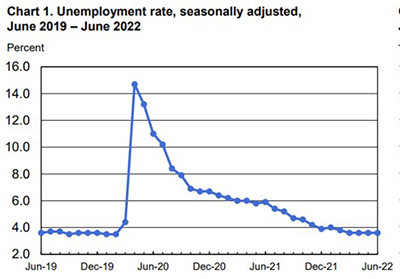

Employment rose by 372,000 jobs in June, the Bureau of Labor Statistics reported Friday, a strong report despite rising inflation and economic uncertainty.

Category: News and Trends

JLL: Real Estate Transparency Gap Widens in Favor of Leading Global Markets

JLL, Chicago, said while many of the world’s leading commercial real estate markets in North America, Western Europe and Australasia are becoming more transparent, most other countries struggle to maintain the pace of transparency improvement.

Dealmaker: NewPoint Provides $69 Million in HUD Refinancing for Denver Multifamily

NewPoint Real Estate Capital LLC provided a $69 million HUD 223(f) loan on behalf of Ascent Westminster LLC to refinance a multifamily property in Westminster, Colo.

MBA Advocacy Update July 11, 2022

MBA submitted recommendations to the GSEs to improve their appraiser guidance for high-quality manufactured housing. Last week, the GSEs also announced they would once again begin engaging in bulk acquisitions of seasoned loans. And MBA issued a white paper examining how climate change is dramatically reshaping lenders’ and policymakers’ approaches to the U.S. residential and commercial real estate markets.

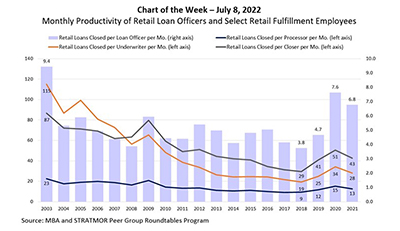

MBA Chart of the Week July 8, 2002: Retail Loan Officer Productivity

In this week’s Chart of the Week, we turn to data from the longstanding MBA and STRATMOR Peer Group Roundtables Program), which recently wrapped up its Spring season for benchmarking lender performance across various production channels and peer groups.

The Week Ahead, July 11, 2022: Five Things to Know

Good morning and happy Monday! Here’s what’s happening this week:

Call for Entries: MBA DEI Leadership Awards–Deadline Aug. 5

The Mortgage Bankers Association is accepting entries for its annual Diversity, Equity and Inclusion Residential Leadership Awards; entry deadline is Friday, Aug. 5.

mPowering You: MBA’s Summit for Women in Real Estate Finance in Nashville Oct. 22

mPowering You: MBA’s Summit for Women in Real Estate Finance, takes place Saturday, Oct. 22 in Nashville, Tenn., ahead of the MBA Annual Convention & Expo.

Quote

“The strong labor market is still a positive for the housing market, but overall demand has cooled from the recent jump in mortgage rates, high home prices and rising economic uncertainty.”

–MBA Chief Economist Mike Fratantoni.

Erin Palmer and Chris Bennett: Rate Lock Negotiations Offer a Short-Term Response with Long-Term Consequences

Rising interest rates and increased competition have loan officers scrambling for ways to win deals in today’s market. One tactic that has grown in popularity with borrowers and loan officers is rate lock renegotiations. However, these come at a high cost to lenders, and with margins already being squeezed, what seems prudent from a customer acquisition standpoint may actually work against lenders’ best interests.