June Jobs Report Beats Estimates

Employment rose by 372,000 jobs in June, the Bureau of Labor Statistics reported Friday, a strong report despite rising inflation and economic uncertainty.

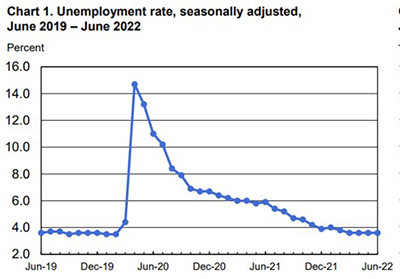

The unemployment rate held at 3.6 percent for the fourth straight month, BLS said, with the number of unemployed persons essentially unchanged at 5.9 million. Prior to the coronavirus pandemic (February 2020), unemployment was at 3.5 percent and the number of unemployed persons stood at 5.7 million.

BLS revised total nonfarm payroll employment for April down by 68,000, from +436,000 to +368,000, and May down by 6,000, from +390,000 to +384,000. With these revisions, employment in April and May combined is 74,000 lower than previously reported. Total nonfarm employment is down by 524,000, or 0.3 percent, from its pre-pandemic level in February 2020. Private-sector employment has recovered the net job losses due to the pandemic and is 140,000 higher than in February 2020, while government employment is 664,000 lower.

The June numbers easily beat consensus predictions of a 278,000 June jobs gain.

The labor force participation rate, at 62.2 percent, and the employment-population ratio, at 59.9 percent, were little changed over the month. Both measures remain below their February 2020 values (63.4 percent and 61.2 percent, respectively).

The report cited notable job gains in professional and business services, leisure and hospitality and health care.

“June’s payroll growth number of 372,000 jobs, and the unemployment rate holding at 3.6%, are both consistent with the strong job market seen thus far in 2022,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “The economy in the first half of the year averaged 450,000 job gains per month, which is an extremely robust pace by historical standards. This labor market strength comes despite other economic data showing signs of weakening and a higher probability of a recession. With the Federal Reserve intently focused on bringing down inflation, we expect this will not alter near-term expectations for another 75-basis-point rate hike at the next FOMC meeting.”

Fratantoni said as to the housing sector, “construction jobs did show a slight gain over the month, mostly driven by nonresidential construction jobs. The housing market continues to suffer from a low supply of homes for sale, as material and labor costs remain elevated. The strong labor market is still a positive for the housing market, but overall demand has cooled from the recent jump in mortgage rates, high home prices and rising economic uncertainty.”

“Better than expected June jobs report gives hope for the likelihood of a ‘soft landing’ and a ‘jobful’ downturn, which may or may not be a ‘recession,’” said Mark Fleming, Chief Economist with First American Financial Corp., Santa Ana, Calif. “The Federal Reserve is hoping to guide the economy to a soft landing – where the Fed’s efforts to tame inflation does not harm employment. The objective is to reduce excess labor demand – a reduction in job vacancies without a significant increase in the unemployment rate. “With better than expected payroll employment, stable unemployment rate and even increased wage gains, the Fed may yet engineer a ‘soft landing.’”

“Another robust gain in payrolls should squash discussions that the economy is already in a recession,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “With hiring still solid, we believe the June jobs report bolsters the case for another 75 basis point rate hike at the FOMC’s July 27 meeting.”

“Residential construction employment (including specialty trade contractors) shrank by 4,100 in June following strong gains in recent months, making it more difficult for builders to fulfill their current orders,” noted Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “We believe this report, in particular the robust payroll and wage gains, should re-affirm the Federal Reserve’s commitment to aggressive policy tightening in the coming months.”

The report said average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents, or 0.3 percent, to $32.08. Over the past 12 months, average hourly earnings have increased by 5.1 percent. Average hourly earnings of private-sector production and nonsupervisory employees rose by 13 cents, or 0.5 percent, to $27.45.

The average workweek for all employees on private nonfarm payrolls held at 34.5 hours in June. In manufacturing, the average workweek for all employees was little changed at 40.3 hours, and overtime fell by 0.1 hour to 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls remained at 34.0 hours.

“Average hourly wages decelerated for the third consecutive month to 5.1% in June, down from a recent peak of 5.6%,” Fratantoni said. “While still proceeding at a strong pace, wage growth continues to trail inflation – especially for important household expenditures such as food, fuel, and housing.”