Delinquency rates for mortgages backed by commercial properties increased during the first quarter of 2025. This is according to the Mortgage Bankers Association’s latest commercial real estate finance Loan Performance Survey.

Tag: Delinquency Rates

MBA: Delinquency Rates for Commercial Property Loans Declined Slightly in Second Quarter of 2024

Delinquency rates for mortgages backed by commercial properties declined slightly during the second quarter of 2024. This is according to the Mortgage Bankers Association’s (MBA) latest commercial real estate finance Loan Performance Survey.

Trepp Reports CMBS Delinquency Rate Dips

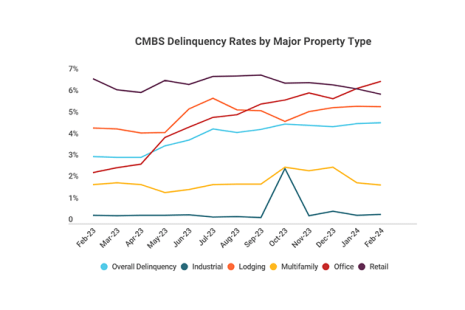

Trepp, New York, reported the commercial mortgage-backed securities delinquency rate dipped back below 5% in May.

MBA: Mortgage Delinquencies Increase Slightly in First Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.94% of all loans outstanding at the end of the first quarter of 2024, according to the Mortgage Bankers Association’s National Delinquency Survey.

CoreLogic: Delinquency, Foreclosure Rates Low in February

CoreLogic, Irvine, Calif., reported the overall mortgage delinquency rate was at 2.8% in February, down from 3% in February 2023.

CoreLogic: January Mortgage Delinquency Rate Near Record Low

CoreLogic, Irvine, Calif., said the U.S. housing market posted an overall delinquency rate of 2.8% in January, approaching a record low.

ICE First Look: Delinquencies Improve in February

Intercontinental Exchange Inc., Atlanta, released its first look at February mortgage performance, noting that the national delinquency rate was at 3.34%, down 4 basis points from the month before and 11 basis points lower than February 2023.

MBA: Commercial and Multifamily Mortgage Delinquency Rates Increased in Fourth Quarter 2023

Commercial mortgage delinquencies increased in the fourth quarter of 2023, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

Office Sector Drives CMBS Delinquency Rate Up Slightly: Trepp

The delinquency rate for commercial mortgage-backed securities inched upward in February, according to Trepp, New York.

CoreLogic: Delinquencies Nearly Flat in December

CoreLogic, Irvine, Calif., reported the national overall mortgage delinquency rate was 3.1% in December, up by 0.1 percentage point year-over-year from December 2022 and 0.2 percentage point from November.