MBA: Mortgage Delinquencies Increase Slightly in First Quarter

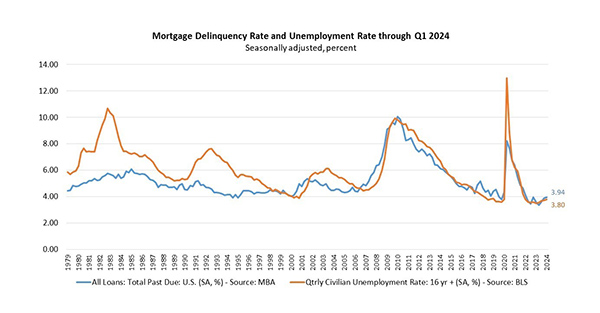

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.94% of all loans outstanding at the end of the first quarter of 2024, according to the Mortgage Bankers Association’s National Delinquency Survey.

The delinquency rate was up 6 basis points from the fourth quarter of 2023 and up 38 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the first quarter remained unchanged at 0.14%.

“Overall mortgage delinquencies increased slightly in the first quarter of 2024, but not across all three of the major loan types. Delinquencies declined for FHA loans, were relatively flat for conventional loans, and increased for VA loans,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis.

Walsh noted all three loan types saw an increase in delinquencies compared to one year ago. “Higher unemployment, lower personal savings, increases in property taxes and insurance, and a run-up in credit card debt and delinquency contributed to conditions that would make it tougher for some homeowners to make their mortgage payments,” she said.

Added Walsh, “At the end of 2023, the Department of Veterans Affairs encouraged mortgage servicers to implement a foreclosure moratorium until the end of May 2024. With this pause came an increase in VA loans that remained delinquent, but not in foreclosure inventory.”

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure.

Key findings of MBA’s First Quarter of 2024 National Delinquency Survey:

Compared to last quarter, the seasonally adjusted mortgage delinquency rate increased for all loans outstanding. By stage, the 30-day delinquency rate increased 15 basis points to 2.25%, the 60-day delinquency rate decreased 6 basis points to 0.67%, and the 90-day delinquency bucket decreased 3 basis points to 1.02%.

By loan type, the total delinquency rate for conventional loans increased 1 basis point to 2.62% over the previous quarter. The FHA delinquency rate decreased 42 basis points to 10.39%, and the VA delinquency rate increased by 59 basis points to 4.66%.

On a year-over-year basis, total mortgage delinquencies increased for all loans outstanding. The delinquency rate increased by 18 basis points for conventional loans, increased 112 basis points for FHA loans, and increased 68 basis points for VA loans from the previous year.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 0.46%, down one basis point from the fourth quarter of 2023 and 11 basis points from one year ago.

The non-seasonally adjusted seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 1.44%. It decreased by 8 basis points from last quarter and decreased by 29 basis points from last year. The seriously delinquent rate decreased 6 basis points for conventional loans, decreased 24 basis points for FHA loans, and remained unchanged for VA loans from the previous quarter. Compared to a year ago, the seriously delinquent rate decreased by 21 basis points for conventional loans, decreased 83 basis points for FHA loans, and decreased 25 basis points for VA loans.

The states with the largest year-over-year increases in their overall delinquency rate were: Louisiana (96 basis points), South Dakota (96 basis points), New Mexico (71 basis points), Texas (66 basis points), Georgia (56 basis points), and North Dakota (56 basis points).

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.

NOTE: For non-seasonally-adjusted (NSA) supplemental information on the performance of servicing portfolios by investor type, loans in forbearance by investor type, and the status of post-forbearance workouts, as well as servicer call volume metrics, please refer to MBA’s Monthly Loan Monitoring Survey at www.mba.org/lms. April results will be released on Monday, May 20, 2024.