CoreLogic: January Mortgage Delinquency Rate Near Record Low

(Image courtesy of CoreLogic)

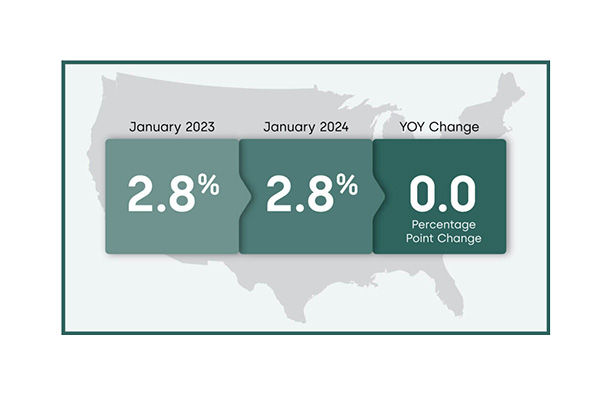

CoreLogic, Irvine, Calif., said the U.S. housing market posted an overall delinquency rate of 2.8% in January, approaching a record low.

That’s flat from January 2023, and down by 0.3 percentage point from December.

The serious delinquency rate was at 1%, and the foreclosure rate was at 0.3%, also near all-time lows.

“Nationwide, the overall mortgage delinquency rate held steady in January, and the serious delinquency rate fell from a year ago,” said Molly Boesel, principal economist with CoreLogic. “However, one-third of metros posted an increase in the overall delinquency rate from one year earlier, and a handful reported an increase in serious delinquency rates.”

By stage:

• Early-stage delinquencies–defined as 30 to 59 days past due–were 1.4%, up from 1.3% in January 2023.

• Adverse delinquencies–defined as 60 to 89 days past due–were 0.5%, up from 0.4% in January 2023.

• Serious delinquencies–defined as 90 days or more past due, including loans in foreclosure–were 1%, down from 1.2% in January 2023.

• The foreclosure inventory rate was 0.3%, flat from January 2023.

• The transition rate–defined as the share of mortgages that transitioned from current to 30 days past due–was 0.6%, also flat from January 2023.

The two states with the largest increase in overall mortgage delinquency rates were Hawaii and Idaho, both up by 0.2 percentage point.

The metro area with the largest increases in year-over-year delinquency rates was Kahului-Wailuku-Lahaina, Hawaii, up 2 percentage points. Jackson, Mich., and New Orleans-Metairie, La., were both up by 0.6 percentage point.