ICE First Look: Delinquencies Improve in February

(Image courtesy of ICE)

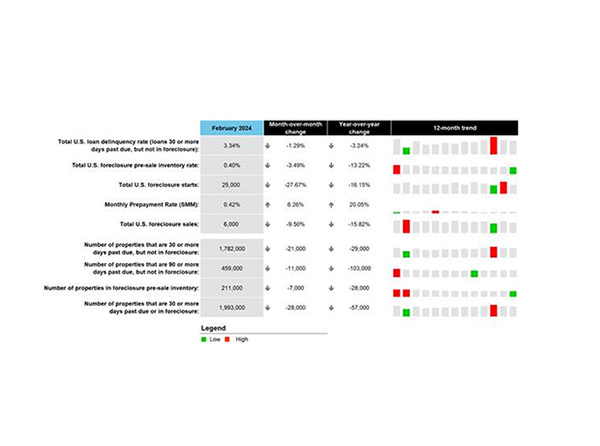

Intercontinental Exchange Inc., Atlanta, released its first look at February mortgage performance, noting that the national delinquency rate was at 3.34%, down 4 basis points from the month before and 11 basis points lower than February 2023.

The number of borrowers 60 or 90 days late fell to their lowest level in three months, but the number of borrowers one payment behind rose by about 10,000.

Serious delinquencies also fell, by 18% year-over-year. That number now stands at about 459,000.

Delinquency inflows were up 6.5% from January’s eight-month low.

There were approximately 25,000 foreclosure starts in February, or 5.3% of serious delinquencies.

The number of loans in active foreclosure fell to 211,000, and are 25% below pre-pandemic levels.

There were 6,000 foreclosure sales completed last month, down 9% from January and the second-lowest level over the past year.

Prepayment activity was up by 3 basis points in February. That’s a level last seen in October, likely propelled by a brief dip in rates that led to some refinance activity.

The top 5 states by non-current percentage are Mississippi at 7.87%, Louisiana at 7.72%, Alabama at 5.79%, Arkansas at 5.15% and Indiana at 5.11%.

The bottom 5 states by non-current percentage are Colorado at 2.01%, Washington at 2.06%, Idaho at 2.14%, California at 2.21% and Montana at 2.22%.