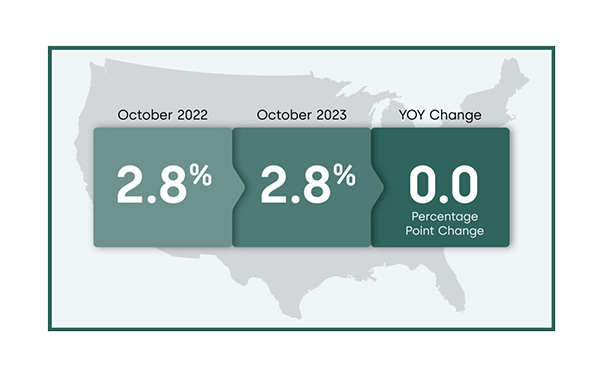

CoreLogic: October Delinquency Rate Flat

(Image courtesy of CoreLogic)

CoreLogic, Irvine, Calif., reported 2.8% of mortgages were delinquent by 30 or more days in October; the same rate was recorded in both September 2023 and October 2022.

“U.S. mortgage delinquency rates remained healthy in October, with the overall delinquency rate unchanged from a year earlier and the serious delinquency rate remaining at a historic low,” said Molly Boesel, Principal Economist for CoreLogic. “Most of the decline in the serious delinquency rate stems from a decrease in later-stage delinquencies. Importantly, there was no increase in the foreclosure rate, indicating that borrowers in later stages of delinquencies are finding alternatives to defaulting on their home loans.”

CoreLogic breaks data down by stages of delinquency:

• Early-stage delinquencies–defined as 30-59 days past due–were 1.4%, up from 1.3% in October 2022.

• Adverse delinquencies–defined as 60 to 89 days past due–were 0.4%, flat from October 2022.

• Serious delinquencies–defined as 90 or more days past due and including loans in foreclosure–were 0.9%, down from 1.2% in October 2022.

• The foreclosure inventory rate–defined as loans in some stage of the foreclosure process–was 0.3%, the same as October 2022.

• The transition rate–defined as the share of mortgages that transitioned from current to 30 days past due–was 0.7%, identical to October 2022.

On a geographic basis, nine states saw overall mortgage delinquency rates increase year-over-year. Those were Hawaii (up 0.5 percentage point); Idaho (up 0.2 percentage point); and Georgia, Louisiana, Mississippi, Oregon, South Dakota, Utah and Washington (all up 0.1 percentage point).

Three metro areas posted increases in serious delinquency rates–Kahului-Wailuku, Lahaina, Hawaii (up by 0.3 percentage point); Punta Gorda, Fla., (up by 0.2 percentage point); and Cape Coral-Fort Myers, Fla., (up by 0.1 percentage point.)