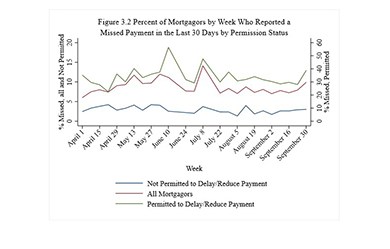

RIHA Study: More than 6 Million Renters and Homeowners and 26 Million Student Debt Borrowers Missed September Payment

More than six million households did not make their rent or mortgage payments, and 26 million individuals missed their student loan payment in September, according to third quarter research released by the Mortgage Bankers Association’s Research Institute for Housing America.

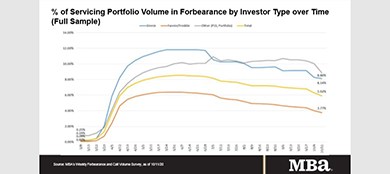

MBA: Share of Mortgage Loans in Forbearance Falls to 5.92%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 40 basis points to 5.92% of servicers’ portfolio volume as of October 11, from 6.32% the prior week. MBA now estimates 3 million homeowners are in forbearance plans.

MBA Annual20: FHFA Proposes Rule for New Enterprise Products, Activities

Federal Housing Finance Agency Mark Calabria yesterday told MBA members that the agency wants comments on a proposed rule that would require Fannie Mae and Freddie Mac to obtain approval for new products and notice before engaging in new activity.

ATTOM: Foreclosure Activity at Historic Lows as Moratorium Stalls Filings

ATTOM Data Solutions, Irvine, Calif., reported just 27,016 properties with foreclosure filings in the third quarter, down by 12 percent from the previous quarter and down by 81 percent from a year ago to the lowest level since it began tracking quarterly filings in 2008.

CoreLogic: Serious Delinquencies Spiking Despite Strong Housing Demand

CoreLogic, Irvine, Calif., reported an increase in overall mortgage delinquency rates in July—and in particular, a spike in serious delinquencies to their highest level in more than six years.