CoreLogic: Serious Delinquencies Spiking Despite Strong Housing Demand

CoreLogic, Irvine, Calif., reported an increase in overall mortgage delinquency rates in July—and in particular, a spike in serious delinquencies to their highest level in more than six years.

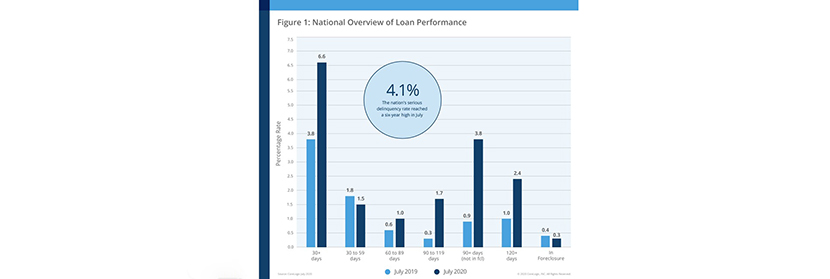

The company’s monthly Loan Performance Insights Report said nationwide, 6.6% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure). This represents a 2.8-percentage point increase in the overall delinquency rate from a year ago. Other key data:

–Early Stage Delinquencies (30-59 days past due): 1.5%, down from 1.8% a year ago and down from 4.2% in April when early stage delinquencies spiked.

–Adverse Delinquency (60 to 89 days past due): 1%, up from 0.6% a year ago, but down from 2.8% in May.

–Serious Delinquency (90 days or more past due, including loans in foreclosure): 4.1%, up from 1.3% a year ago. This is the highest serious delinquency rate since April 2014.

–Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, down from 0.4% a year ago. The 2020 foreclosure rate is the lowest for any month in at least 21 years.

–Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.8%, unchanged from a year ago. The transition rate has slowed since April, when it peaked at 3.4%.

Despite home values, measured by the CoreLogic Home Price Index, rising at an accelerated rate, unemployment levels in hard-hit areas remained stubbornly high, leaving some borrowers house-rich but cash poor. Despite the slow reopening of several sectors of the economy, recovery for other industries such as entertainment, tourism, oil and gas have a more uncertain outlook for the remainder of 2020. With persistent job market and income instability, Americans continue to tap into savings to stay current on their home loans. But as savings run out, borrowers could be pushed further down the delinquency funnel.

“Many Americans, particularly millennials, are taking advantage of low rates to either purchase their first home or upgrade their living situations,” said Frank Martell, president and CEO of CoreLogic. “However, given the unsteadiness of the job market, many homeowners are beginning to feel the compounding pressures of unstable income and debt on personal savings buffers, creating heightened risk of falling behind on their mortgages.”

“Four months into the pandemic, the 120-day delinquency rate for July spiked to 1.4%,” said Frank Nothaft, chief economist withCoreLogic. “This was the highest rate in more than 21 years and double the December 2009 Great Recession peak. The spike in delinquency was all the more stunning given the generational low of 0.1% in March.”

CoreLogic reported all states logged annual increases in both overall and serious delinquency rates. COVID-19 hotspots were again impacted the most, with Nevada (up 5.2 percentage points), New Jersey (up 4.8 percentage points), Hawaii (up 4.7 percentage points), New York (up 4.6 percentage points) and Florida (up 4.4 percentage points) topping the list for overall delinquency gains.

Similarly, all U.S. metro areas logged at least a small increase in serious delinquency rates in July. Odessa, Texas — which has been hard hit by job loss in the oil and gas industry — experienced the largest annual increase, up 7.5 percentage points. Other metro areas with significant serious delinquency increases included Laredo, Texas (up 6.6 percentage points); Miami (up 6.4 percentage points); McAllen, Texas (up 6.2 percentage points) and Kahului, Hawaii (up 5.9 percentage points).

Nothaft said with industries such as oil and gas projected to leave millions of jobs unrestored throughout the remainder of the year, “we may expect to see continued increases in mortgage delinquencies.”