When we think of the investments that companies are making in new AI-powered software, the big tech firms spring to mind first. With Google investing over $300 billion and Facebook and Microsoft close behind, it’s clear that someone thinks “thar’s gold in them there mountains.”

Category: News and Trends

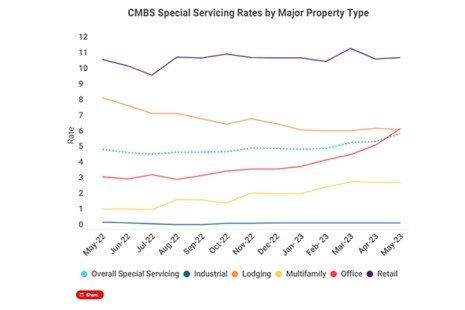

Trepp: CMBS Special Servicing Rate Rises to 6.11%

Trepp, New York, reported its CMBS Special Servicing Rate climbed 49 basis points to 6.11% in May, marking its fourth sequential monthly increase.

Christine Chandler of M&T Realty Capital Corp. Nominated to Be 2024 MBA Vice Chair

The Mortgage Bankers Association announced that Christine Chandler, Executive Vice President, Chief Credit Officer and Chief Operating Officer with M&T Realty Capital Corp. (RCC), has been nominated to serve as MBA’s Vice Chair for the 2024 membership year.

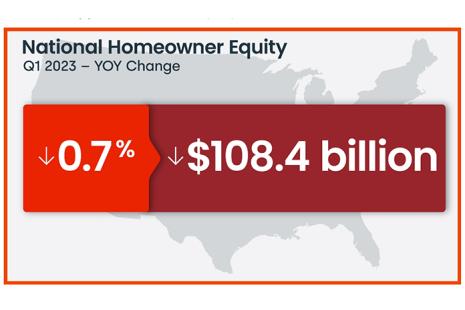

CoreLogic Reports Borrowers See First Annual Home Equity Losses Since 2012

U.S. homeowners with mortgages saw their home equity decrease by 0.7% year-over-year–an average loss of $5,400 per borrower–according to CoreLogic, Irvine, Calif.

MISMO Seeks Public Comment on New Standardized Dataset for VA Verification of Benefits

MISMO®, the real estate finance industry’s standards organization, announced at its 2023 Spring Summit it is seeking public comment on a MISMO dataset mapping for the U.S. Department of Veterans Affairs Verification of Benefits (Form 26-8937).

David Allison from Dovenmuehle: Context Is Key in Formulating a Response to Mortgage Default Data

For those who attended MBA’s Servicing Solutions Conference in February, the unveiling of the delinquency data for the fourth quarter of 2022 caused quite a stir.

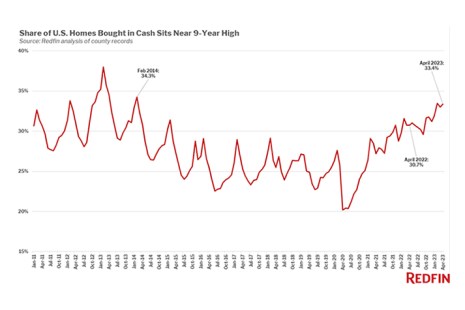

One-Third of Homebuyers Used Cash in April, Redfin Finds

Redfin, Seattle, reported 33.4% of home purchases in April were all-cash, almost the highest share in nine years and up from 30.7% in April 2022.

Commercial Real Estate Reset? A Special Servicing Roundtable

As property sale transactions and originations stall, MBA NewsLink interviewed two special servicing executives and a CMBS researcher to get their insights on the commercial real estate finance landscape and outlook.

Quote: Tuesday, June 13, 2023

“Christine Chandler is a passionate and influential leader in real estate finance and is a terrific choice to lead MBA and its members through the challenges and opportunities our industry faces.”

–Matt Rocco, 2023 MBA Chairman and President of Colliers Mortgage

Be a DEI Champion: Deadline Aug. 4

MBA’s Diversity, Equity and Inclusion Leadership Awards recognize leading organizations who are exhibiting exemplary leadership through their impactful DEI efforts. We want to hear more about your DEI strategy, implementation, …