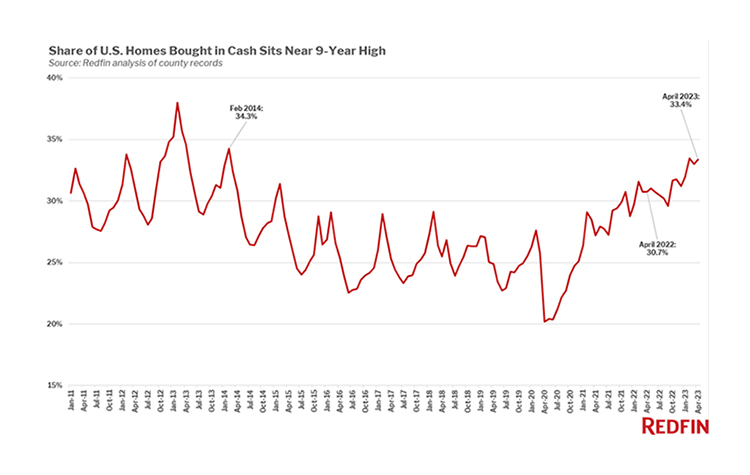

One-Third of Homebuyers Used Cash in April, Redfin Finds

(Courtesy Redfin)

Redfin, Seattle, reported 33.4% of home purchases in April were all-cash, almost the highest share in nine years and up from 30.7% in April 2022.

Redfin pointed to a primary reason for the increase: While higher rates are deterring buyers who would rely on mortgages, all-cash buyers aren’t as affected. Overall home sales were down 41% year-over-year in the metro areas Redfin analyzed, but all-cash sales were only down 35%.

“A homebuyer who can afford to pay in all cash is weighing two potential paths,” said Redfin Senior Economist Sheharyar Bokhari. “They can use cash to pay for the home and avoid high monthly interest payments, or take out a loan and pay a high mortgage rate. In that case, they could use the money that would have gone toward an all-cash purchase to invest in other assets that offer bigger returns, which could partly cancel out their high mortgage rate.”

Competition may also be driving up all-cash purchases somewhat, as those can prove winning offers in a bidding war.

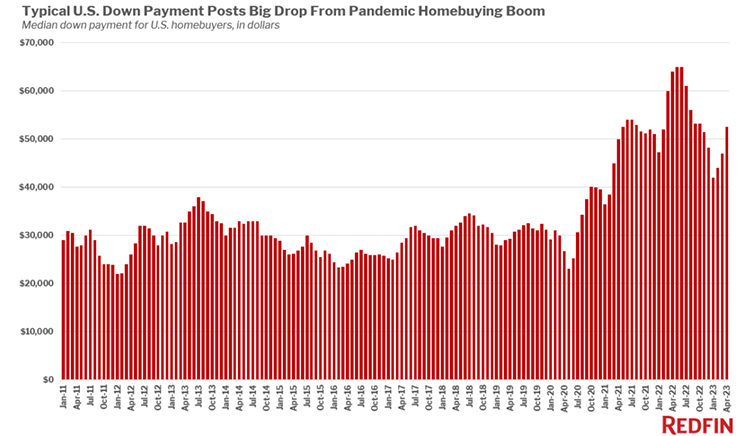

Additionally, median down payments were down in April. The typical down payment was $52,500, down 18% year-over-year and the second-biggest drop since May 2020. Down payments have been falling year-over-year since November.

FHA loans were up as a percentage of purchases, at about 16.4% in April. That’s a notable increase from 10.4% a year earlier. They’ve become more common as high mortgage rates have cooled the market–FHA loans were losing out to buyers with all-cash or conventional loans during the stretch of highest competition.

Jumbo loans have also become less popular given current conditions, dropping to 6.1% of mortgaged home sales from 10.6% year-over-year. However, that’s up from the decade-low drop to 4.3% in January.

Redfin analyzed county records across 40 of the most populous U.S. metropolitan areas back through 2011.