David Allison from Dovenmuehle: Context Is Key in Formulating a Response to Mortgage Default Data

David Allison is Senior Vice President of Business Development with Dovenmuehle Mortgage, Lake Zurich, Ill.

For those who attended MBA’s Servicing Solutions Conference in February, the unveiling of the delinquency data for the fourth quarter of 2022 caused quite a stir. Of course, any spike in default-related data will instantly raise eyebrows and send the thoughts of many industry veterans hurling back to the Great Recession. However, there are marked differences between today’s market and that of 2007 to 2009, and lenders and servicers need to put today’s numbers into historical context so that they can adequately prepare themselves.

Digging into the Data

According to the MBA’s Q4 2022 National Delinquency Survey, which was released during the conference, overall mortgage delinquency rates increased 51 basis points over the previous quarter for a seasonally adjusted rate of 3.96%. The natural reaction to that news was concern, and rightfully so. Given the tight origination market, lenders that retain servicing are relying heavily on that income stream to carry them through the current lean times. Thus, a rise in delinquencies potentially puts that revenue stream in jeopardy. Higher delinquency and default rates can also cause higher monthly advances and increased unreimbursed foreclosure costs – all of which are significant concerns during these times of tighter margins and reduced liquidity.

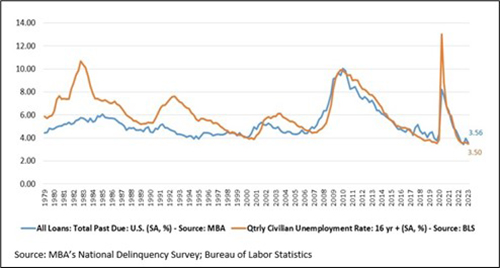

However, that singular data point does not tell the whole story regarding the current delinquency environment. For example, Q3 2022’s delinquency rate of 3.45% (one quarter prior to the data presented during the MBA Servicing Solutions Conference) was the lowest in the survey’s history, and delinquency rates have steadily declined since peaking around Q2 2020 at the start of the COVID-19 pandemic in the U.S. That peak, which edged just past the 8% mark, was still nearly 200 bps lower than the survey’s historical high of 10.06% back in Q1 2010.

Taking the “COVID quarters” out of the equation, Q4’s delinquency rate is roughly in line with what lenders experienced in late 2019 and well below what the industry experienced during the tail end of the Great Recession, during which the delinquency rate was persistently in the 9 to 10% range. Furthermore, the most recent National Delinquency Survey released on May 10 shows that delinquency rates for Q1 2023 declined to 3.56%, just 11 bps over Q3 2022’s historic low and representing the second lowest level in the history of this quarterly MBA data.

It’s also important to note that the MBA asked lenders to include loans in forbearance as part of their delinquency reporting. In March 2020, the MBA began tracking forbearances as a percentage share of overall servicing portfolio volume. After rising precipitously throughout April 2020, forbearance share leveled somewhat in mid-2020, peaking at 8.55% in early June. From that point, forbearance share dropped steadily throughout the subsequent months, and as of April 30, 2023, forbearances only comprised 0.51% of servicers’ portfolios. Thus, even taking forbearances into account, delinquencies have been historically low over the past two years.

While some predict that potentially higher unemployment will drive up the number of “seriously” delinquent mortgages (e.g., those that are 90+ days delinquent), lenders and servicers must also put those numbers into context. At face value, 580,000 seriously delinquent loans sound like a considerable number, especially compared to 264,000 seriously delinquent mortgages in 2021 and 256,000 in 2022. Furthermore, qualifying this number in terms such as “levels not seen since 2016,” it’s easy to feel that trouble is on the horizon.

Yet, the levels predicted for this year would be on par with those observed in 2017, which was approximately 549,000 and nearly 100,000 less than 2016’s total of 662,000 seriously delinquent loans. Of all the topics dominating the headlines that year – TRID, the U.S. Presidential election, interest rates, etc. – delinquencies and foreclosures fell relatively low on the list. In fact, economists at the time said that default and foreclosure rates had finally returned to historic levels in the wake of the subprime crisis and the Great Recession.

In addition, distressed homeowners today have more options at their disposal than were available during the Great Recession. Home equity has risen to such a degree that many of these borrowers may be able to sell their homes rather than defaulting on their mortgage and entering into foreclosure with a total loss of their accumulated net equity. While that’s not necessarily great news for the lenders relying on the servicing revenue from those loans, it’s a far better outcome for the borrowers, lenders and investors than the alternative.

Delinquency rates tend to closely track employment and income levels over time. Given today’s historically low unemployment rates, a sudden or severe upturn in delinquency levels seems unlikely. If the economy slows and enters a “mild” recession, unemployment and delinquencies will both trend upward but not to the levels seen during the Great Recession. Any increase in delinquencies would also most likely happen gradually, unlike a sudden spike in prepayment speeds when interest rates decline.

With that in mind, servicers can take multiple steps to prepare for a softening economy. These include:

-Ensuring proper staffing levels in the delinquency and default areas of the servicing operation;

-Fully updating policies and procedures related to servicing, delinquency, default and loss mitigation;

-Training and retraining servicing staff in these key areas;

-Deploying advanced digital servicing technologies to enable borrowers to explore and initiate workout and loss mitigation solutions online; and

-Leveraging educational videos to help borrowers who are experiencing financial hardships to help them understand all available forbearance and modification options.

While Q4’s modest rise in delinquencies were certainly worthy of notice, Q1’s improvement demonstrates that fears of rapidly increasing delinquencies were largely unfounded – a fact underscored by economic indicators and strong property appreciation. But as the saying goes, “Failing to prepare is preparing to fail.” Coming out of a period of historic delinquency lows, servicers should prepare themselves for an increase in delinquencies in the coming quarters, but those preparations must be made with the proper context in mind.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to NewsLink Editor Michael Tucker at mtucker@mba.org or Editorial Manager Anneliese Mahoney at amahoney@mba.org.)