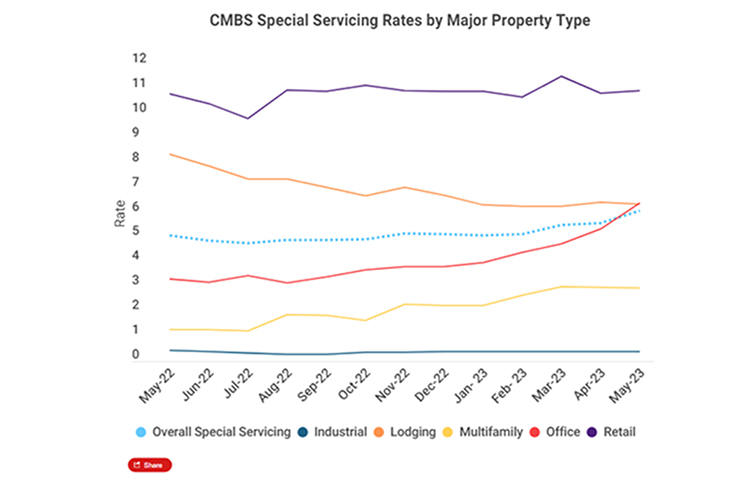

Trepp: CMBS Special Servicing Rate Rises to 6.11%

(Courtesy Trepp)

Trepp, New York, reported its CMBS Special Servicing Rate climbed 49 basis points to 6.11% in May, marking its fourth sequential monthly increase.

Trepp pegged mixed use and office as the property types mostly responsible for the rise. The rate for mixed-use backed loans was up 150 basis points to 5.65% from April and the office sector rose 104 basis points to 6.43%. Additionally, mixed use was responsible for 55.3% of new special servicing transfers and the office sector was responsible for 41.2%.

“To put this into perspective, this is the first time the office special servicing rate has been above 6% since December 2017, and this is the largest month-over-month increase in the office special servicing rate since 2010,” said Jack LaForge, Associate Research Manager at Trepp.

The overall CMBS 1.0 special servicing rate is 32.36%; the overall CMBS 2.0+ special servicing rate is 5.89%.

Trepp also highlighted a few major loan to transfer instances, including the largest, a $1.1 billion Workspace Property Trust Portfolio loan backed by 147 properties with mostly flex office space. Trepp noted comments were sparse as to why the loan was transferred.

Another highlighted loan to transfer was the 375 Park Avenue Loan, with collateral of an 830,000-square-foot office space in Manhattan. Comments note the loan was extended to May 2024, with an option to further extend another year, and the borrower will be required to make $40 million in additional principal payments over the next two years.