LAS VEGAS–What impact will AI have on the mortgage banking industry? Is it a bubble? How does it fit into the customer experience?

Tag: Technology

ICE Mortgage Technology’s Sandra Madigan: When Technology Supports Empathy, Everyone Wins

Exceptional customer experiences transform lives. That’s especially true in mortgage servicing, where the experience we’re supporting is home ownership – and all the well-being, wealth-building and financial commitment that entails.

Insellerate’s Josh Friend: Embracing Technological Advancements in Changing Markets

Rapidly changing market conditions and consumer behavior demand lenders reevaluate their technological strategies. Even if lenders previously explored technology solutions a year or two ago, the present moment calls for a fresh perspective and reexamination of available tools.

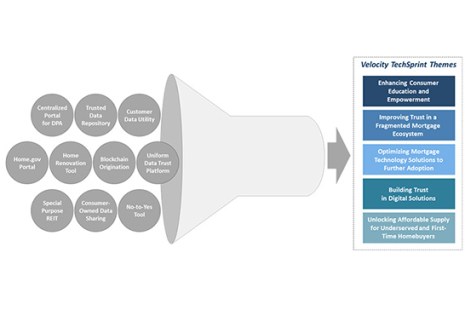

FHFA TechSprint Spotlights Themes Related to Mortgage Technology

The Federal Housing Finance Agency last summer held its “Velocity” TechSprint, bringing people together to ponder how data digitization could drive transparency and increase access, fairness, affordability and sustainability in mortgage lending. FHFA briefed MISMO Winter Summit attendees about the program Monday.

Rapidio’s Michael Tuch: Hone Your Lending Operations to Reduce Origination Costs, Strengthen Profitability

Lenders must use the current market to hone their lending operations and uncover greater efficiencies that drive stronger profitability and drive down origination costs long term.

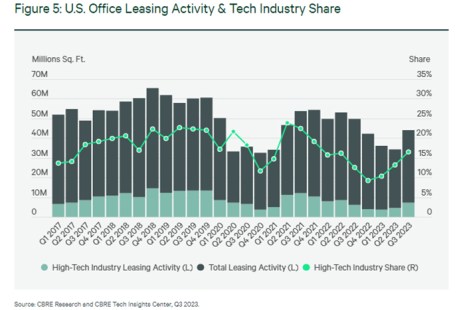

Tech Industry Leasing More Offices, CBRE Finds

CBRE, Dallas, reported that despite challenges in the sector, the tech industry has reclaimed the largest share of U.S. office leasing in the third quarter.

Terrell Cassada of LoanLogics: Real Secondary Market Loan Confidence Happens from Within

New technologies, including AI, machine learning tools and rules-driven workflow, are finally being applied to the loan production process with gusto. Real results are being achieved through automation that drives fewer underwriting touches and exposes quality issues earlier in the production process. And now the secondary market—one of the last remaining components of loan manufacturing still awash in spreadsheets, manual processes, and data inconsistencies—is finally getting its turn at bat.

Jason Wilborn of Accenture Credit Services: Tech Dreams

I was listening to a panel of industry executives when it occurred to me something incredibly important was missing from the conversation topics. The all-important intangible component, the dream of home ownership. The dream you ask? More on what I mean in just a minute.

Jason Wilborn of Accenture Credit Services: Tech Dreams

I was listening to a panel of industry executives when it occurred to me something incredibly important was missing from the conversation topics. The all-important intangible component, the dream of home ownership. The dream you ask? More on what I mean in just a minute.

Jason Wilborn of Accenture Credit Services: Tech Dreams

I was listening to a panel of industry executives when it occurred to me something incredibly important was missing from the conversation topics. The all-important intangible component, the dream of home ownership. The dream you ask? More on what I mean in just a minute.