FHFA TechSprint Spotlights Themes Related to Mortgage Technology

(Image courtesy of FHFA)

The Federal Housing Finance Agency last summer held its “Velocity” TechSprint, bringing people together to ponder how data digitization could drive transparency and increase access, fairness, affordability and sustainability in mortgage lending. FHFA briefed MISMO Winter Summit attendees about the program Monday.

“We had a big, audacious goal of bringing together the mortgage industry to collaborate with each other and with the regulator to iterate on big ideas toward solving some of the industry’s most intractable problems in the use and adoption of responsible tech and innovation in mortgage processes today,” said Anne Marie Pippin, Associate Director, Office of Financial Technology at FHFA, while speaking at the MISMO Winter Summit, held Jan. 8-11 in Houston.

The TechSprint was designed to deep dive into the challenges causing slow adoption. To do so, 80 participants (representing 60 entities) were divided into 10 teams to contemplate that overall question over the four-day event. Participants included technology service providers, academics, regulators and mortgage industry experts.

FHFA has acknowledged that despite significant innovation in the mortgage technology space, many members still use paper-based processes.

The agency noted that there are significant benefits to the adoption of digital solutions, including research that indicates mortgage lenders who embrace such solutions have lower costs and provide higher-quality loans. Additionally, homebuyers continue to show interest in using online or digital tools during their buying process.

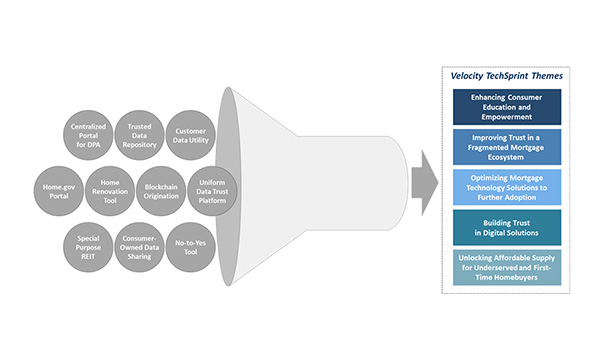

FHFA was able to identify five key themes arising from the solutions pitched; the agency also conducted further interviews and analysis with each team to better understand their thinking.

The first theme was “Enhancing Consumer Education and Empowerment.” The sprinters observed the overwhelming nature of the homebuying process, and noted that while there are programs and educational resources for buyers, there are still gaps that need to be filled.

The sprinters proposed that “financial education resources related to mortgages could be further centralized and enhanced to provide more practical information to better prepare prospective homebuyers for the mortgage process and assess their mortgage eligibility before initiating an application,” per a summary of the themes identified during the TechSprint.

Improving information regarding DPA programs was noted, due in large part to significant interest from underserved homebuyers in these programs. In general, the need for better resources for underserved and first-time homebuyers was highlighted.

The second theme was “Improving Trust in a Fragmented Mortgage Ecosystem”—sprinters noted that there’s a lack of trust regarding data exchanged throughout the mortgage ecosystem. That leads to multiple stakeholders conducting their own due diligence, contributing to extra time and cost during the mortgage process.

To ameliorate those issues, sprinters suggested increased government involvement to establish a trusted stream of data.

Theme No. 3 was “Optimizing Mortgage Technology Solutions to Further Adoption.”

Some sprinters have observed current mortgage technology solutions options are both complicated and varied, and it can be tough for companies to justify investment in costly new ones. They highlighted the value of solutions designed to both streamline data across different phases of the origination process and verify homebuyer data, and believed such solutions could lead to increased adoption.

The fourth theme–“Building Trust in Digital Solutions”–was based on sprinters’ observations that many in the origination space have a preference for paper documents.

Other issues along this theme include that in some cases, obtaining paper documents may streamline lender engagement with a homebuyer, and that homebuyers may not want to release their digital information.

Finally, sprinters identified a fifth theme: “Unlocking Affordable Supply for Underserved and First-Time Homebuyers.”

The need for more affordable housing in the U.S. is certainly no secret, and ideas garnered from the sprint included offering underserved and first-time homebuyers a first opportunity to purchase underutilized yet affordable homes. They also suggested providing such buyers with a centralized platform equipped with educational resources to assist them in identifying and renovating suitable properties.

“I definitely want to emphasize that FHFA is very committed to sustaining its engagement with the mortgage industry around responsible innovation broadly,” Pippen said. “We will continue engagement with stakeholders through external outreach and active participations in industry forums–like the MISMO summits and others–to refine our understanding of the TechSprint themes and explore potential pathways toward addressing them.”