Tech Industry Leasing More Offices, CBRE Finds

(Image courtesy of CBRE)

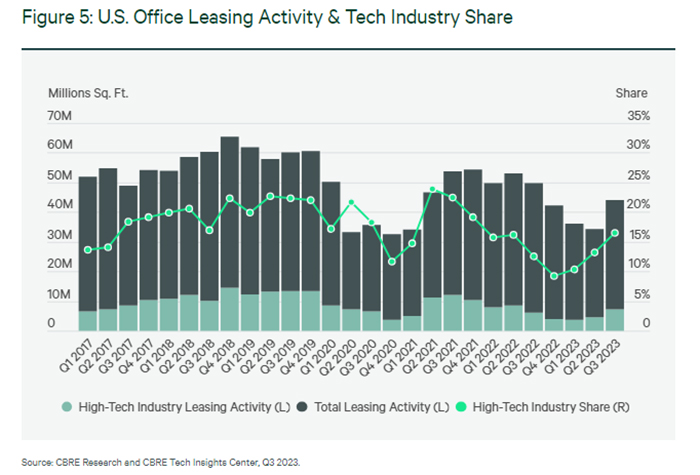

CBRE, Dallas, reported that despite challenges in the sector, the tech industry has reclaimed the largest share of U.S. office leasing in the third quarter.

Tech had lost that spot in the first quarter, CBRE’s annual Tech-30 report found. Tech’s share of office leasing was 16.5%, or 7.3 million square feet, in the quarter. No. 2 is the finance and insurance sector, at 15%.

A particular bright spot is the artificial intelligence sector; CBRE noted those firms are getting a serious infusion of venture capital cash.

AI companies have received $110 billion in venture capital funding since 2019, with the San Francisco area leading the way. Since 2019, 7.5 million square feet of space has been leased by such companies.

“Tech-office leasing has steadily increased this year, but short-term momentum could shift along with the economy. To be sure, long-term growth prospects of the tech industry remain strong with ample capital to fund innovation,” said Colin Yasukochi, executive director of CBRE’s Tech Insights Center in San Francisco. “Investment in emerging technologies like artificial intelligence can produce significant economic value, employment and office space demand. The impact of AI on business growth has the potential to reach the same scale as the mobile internet, which would result in significant demand in the Tech-30 markets.”

Despite layoffs over the past year, current U.S. tech industry employment remains above pre-pandemic levels. CBRE noted 547,000 jobs have been created in the sector since the pandemic’s onset.

Vancouver, Austin, Texas, and Denver saw the largest high-tech job growth over the past two years.

Looking forward, CBRE pegged Vancouver, Boston, Salt Lake City, New York and Charlotte, N.C., as having the “best combination of future tech demand drivers and office market fundamentals.”