CBRE, Dallas, found the multifamily market showed signs of stabilization in the second quarter.

Tag: Multifamily

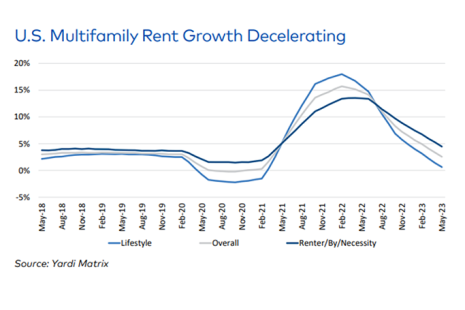

Yardi Matrix: Multifamily Rents See Small Growth in First Half of 2023

Yardi Matrix, Santa Barbara, Calif., found multifamily asking rents grew $17, or 0.9%, with year-over-year growth decelerating to 2.6% through the first five months of 2023.

Apartment Asking Rents Climbing at Slightly Subdued Pace

Zillow, Seattle, reported apartment asking rents climbed by 0.6%, or $12, from March to April, bringing the Zillow Observed Rent Index to $2,018.

CBRE: Multifamily Fundamentals Begin to Stabilize

The U.S. multifamily sector is beginning to stabilize as vacancy rate expansion and negative absorption ease, reported CBRE, Dallas.

CBRE: Looming Multifamily Oversupply Likely Short-Lived

CBRE, Dallas, said delivery of a near-record 716,000 new multifamily units over the next two years will create a short-term oversupply, but noted the new supply will keep long-term fundamentals healthy.

#MBACREF23: Multifamily Leadership Perspectives

SAN DIEGO–Senior government executives visited the MBA Commercial/Multifamily Finance Convention & Expo 2023 to discuss their successes and challenges, including how to increase the national supply of affordable housing.

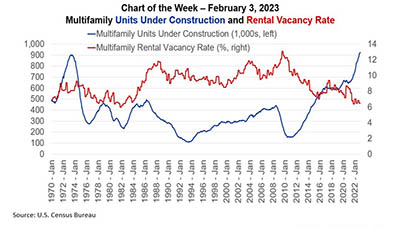

MBA Chart of the Week Feb. 3, 2023: Multifamily Construction/Vacancies

At the end of this week, many of us will begin our annual migration to San Diego and to MBA’s Commercial/Multifamily Finance Convention & Expo (CREF23). There will be no lack of topics to discuss – from return to the office, to the return of retail, and interest in cap rates to interest rate caps.

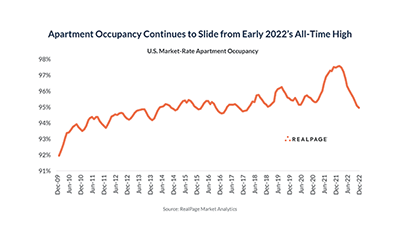

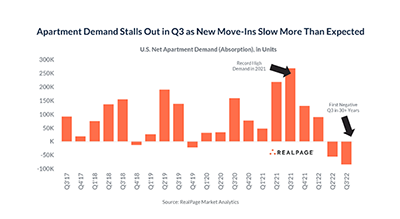

RealPage: Apartment Demand Turns Negative for the First Time Since 2009

RealPage, Richardson, Texas, said net demand for apartments finished 2022 in negative territory for the first time in years.

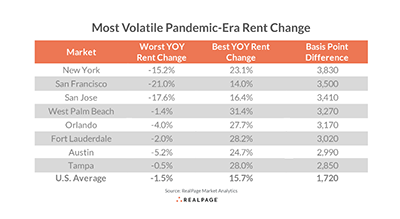

RealPage: Gateway Markets See More Volatile Apartment Rents

The COVID pandemic hit apartment markets nationwide, but different markets saw very different effects, reported RealPage, Richardson, Texas.

RealPage: Apartment Demand Plunges in Third Quarter

RealPage, Richardson, Texas, said apartment demand plunged in the third quarter as new leasing stalled far more than expected.