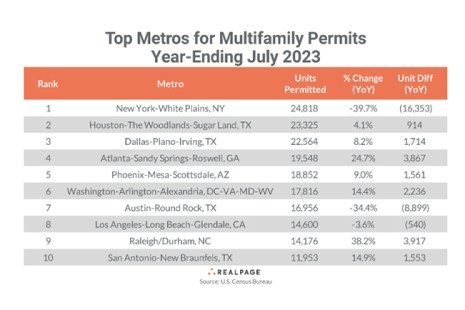

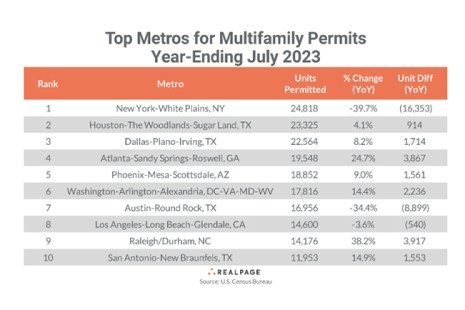

RealPage Analytics, Richardson, Texas, reported the seasonally adjusted annual rate for multifamily permitting fell 32.2% year-over-year in July, per an analysis of Census Bureau data.

Tag: Multifamily

Multifamily Permitting Falls, RealPage Analytics Notes

RealPage Analytics, Richardson, Texas, reported the seasonally adjusted annual rate for multifamily permitting fell 32.2% year-over-year in July, per an analysis of Census Bureau data.

Multifamily Permitting Falls, RealPage Analytics Notes

RealPage Analytics, Richardson, Texas, reported the seasonally adjusted annual rate for multifamily permitting fell 32.2% year-over-year in July, per an analysis of Census Bureau data.

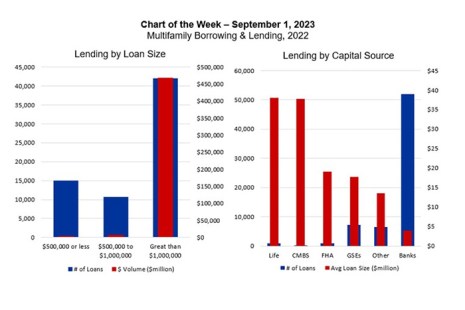

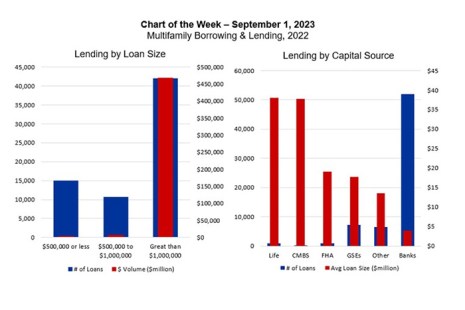

MBA Chart of the Week: Multifamily Borrowing and Lending, 2022

With more than $4.5 trillion of mortgage debt outstanding, commercial real estate finance markets are large and diverse.

Chart of the Week Sept. 5: Multifamily Borrowing and Lending, 2022

With more than $4.5 trillion of mortgage debt outstanding, commercial real estate finance markets are large and diverse.

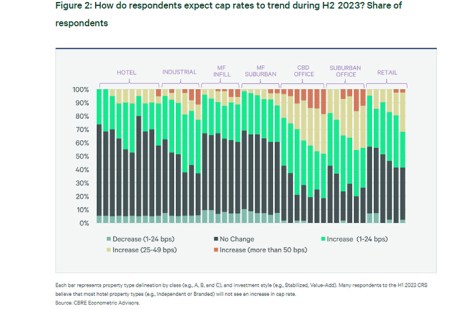

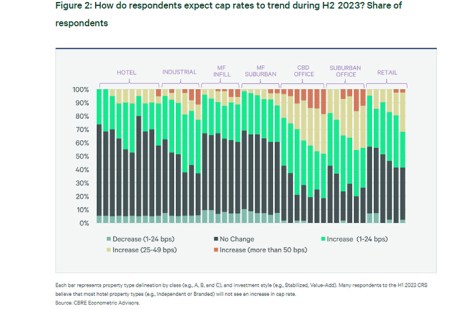

CBRE Survey Points to Expectations of Commercial Real Estate Price Stabilization

CBRE, Dallas, found in a survey that capitalization rates have begun to level off, and in a release said commercial real estate pricing appears poised to stabilize in the second half of this year.

CBRE Survey Points to Expectations of Commercial Real Estate Price Stabilization

CBRE, Dallas, found in a survey that capitalization rates have begun to level off, and in a release said commercial real estate pricing appears poised to stabilize in the second half of this year.

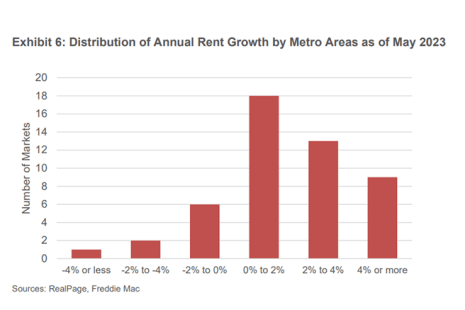

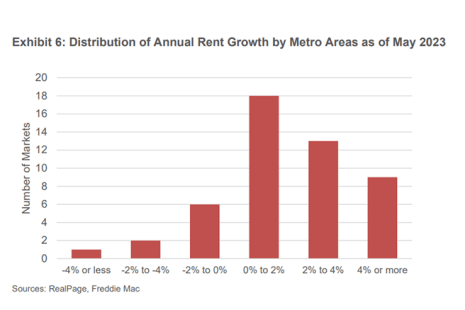

Freddie Mac: Multifamily Demand Returning Slowly in Uncertain Economic Climate

Freddie Mac, McLean, Va., projects the multifamily market will continue to stabilize but see below-average growth through the rest of the year.

Freddie Mac: Multifamily Demand Returning Slowly in Uncertain Economic Climate

Freddie Mac, McLean, Va., projects the multifamily market will continue to stabilize but see below-average growth through the rest of the year.

CBRE: Multifamily Market Continues to Stabilize

CBRE, Dallas, found the multifamily market showed signs of stabilization in the second quarter.