CBRE: Looming Multifamily Oversupply Likely Short-Lived

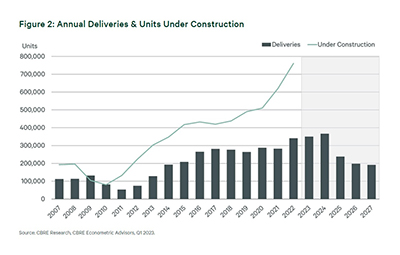

CBRE, Dallas, said delivery of a near-record 716,000 new multifamily units over the next two years will create a short-term oversupply, but noted the new supply will keep long-term fundamentals healthy.

In an Intelligent Investment report, CBRE said the construction surge could push the multifamily sector’s overall vacancy rate above equilibrium to a peak of 5.2% from 4.6% by year-end. “While this may be surprising, given the overall housing shortage in the U.S., the lack of supply is predominantly in single-family homes and not multifamily units,” the report said. “CBRE expects that demand for rental housing will gain momentum this year as vacancy peaks only slightly above its long run average.”

Despite a multifamily unit surplus over the short-term, CBRE forecasts the U.S. will need an additional 2.3 million new units to maintain healthy market fundamentals over the next 10 years. Once the largest portion of the delivery wave has concluded through 2024, the U.S. will still need nearly 200,000 additional units annually to maintain proper supply and demand balance, the report said.

“While a multifamily development surplus in the next 18 months may weigh on market fundamentals in the short-term, new deliveries will be limited beginning in 2025 and will ultimately lay the foundation for a healthy market throughout the next cycle,” said Kelli Carhart, Leader of Multifamily Capital Markets for CBRE in the U.S.

The multifamily pipeline currently exceeds 750,000 units under construction–the highest amount since the housing boom of the 1980s. “Most of these new units are in markets such as Dallas, Austin and Atlanta that experienced the greatest in-migration during the COVID-19 pandemic,” the report said. “Although population growth in these markets is beginning to slow, the rapid increase in construction costs due to inflation and supply chain disruptions has caused multifamily starts to slow as well, meaning that the construction peak is likely occurring now.”

The current construction wave could expand multifamily inventory by 4.2% in the U.S. over the next two years. Although the sector has recorded negative net absorption over the past three quarters, demand will likely turn positive in first-half 2023, limiting how much rising vacancies could slow rent growth. CBRE noted it expects 3.5% rent growth for the year, down from 6.7% last year and 13.4% in 2021 but relatively healthy compared with the sector’s 2.5% long-run average.