RealPage: Gateway Markets See More Volatile Apartment Rents

The COVID pandemic hit apartment markets nationwide, but different markets saw very different effects, reported RealPage, Richardson, Texas.

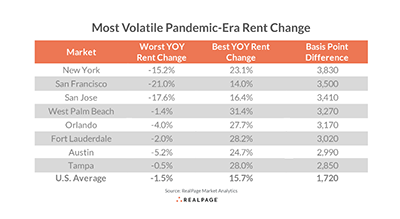

“Apartment markets across the U.S. have experienced unprecedented rent change performances since the onset of the pandemic, with extreme differences in rent change levels over time and among regions and markets,” said RealPage Analyst Charlotte Wheeler. She noted annual effective asking rent cuts bottomed out at 1.5% nationwide in late summer and early fall 2020 before surging as much as 15.7% in March 2022.

Among regions, the largest differentials during the pandemic were in the West and South. Both saw rent changes exceeding 1,900 basis points. The Midwest saw a much lower 1,040-basis-point differential, followed by the Northeast at 1,440 basis points. RealPage calculated an 890-basis-point difference among regions between the steepest effective asking rent decreases and the largest increases since the pandemic started.

Looking at the nation’s 50 largest markets since the onset of the pandemic, rent change was even more varied,” the report said Gateway markets were especially hard hit from mid-2020 to mid-2021 before rebounding at a notable clip.” New York bounced between 15.2% rent cuts in March 2021 to 23.1% rent hikes a year later.

The Bay Area was also hit hard during the pandemic, with San Francisco and San Jose recording very large swings in rents,” the report said. San Francisco and San Jose recorded 3,500- and 3,410-basis-point differentials, while Oakland saw a much smaller 1,770 basis point differential.

Another hard-hit gateway market was South Florida. While south Florida did not see the drastic rent cuts that occurred in New York and the Bay Area in 2021, the region has witnessed exorbitant rent growth throughout much of the past year.” In the pandemic’s early says in 2020, south Florida markets recorded 1% to 3% rents cuts. But since then, rent growth has approached 30%.

Wheeler noted eight Midwest markets ranked among the nation’s least volatile with respect to rent change. Minneapolis was the least volatile market in the nation based on rent change variation during the pandemic, she said. Although Minneapolis was the only large Midwest market to record rent cuts during the pandemic, it has also seen the least amount of rent growth among the nation’s largest 50 markets.

Minneapolis has seen rent increases in the 6.5% range since the start of the pandemic, the third-weakest performance among the nation’s 50 largest markets, RealPage reported.