CBRE: Multifamily Fundamentals Begin to Stabilize

The U.S. multifamily sector is beginning to stabilize as vacancy rate expansion and negative absorption ease, reported CBRE, Dallas.

CBRE noted it expects these trends to continue in its first-quarter U.S. Multifamily Report.

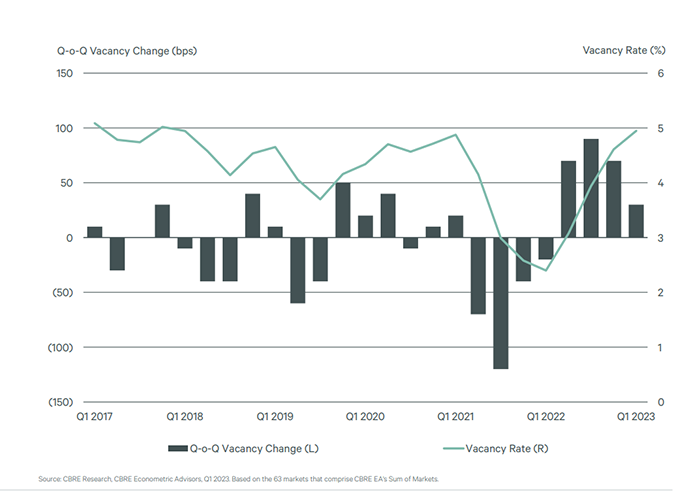

The overall multifamily vacancy rate increased by 30 basis points quarter-over-quarter in the first quarter to 4.9%, but this was less than the 70 basis point increase in late 2022 and the 90-basis point jump in second-quarter 2022.

In addition, first-quarter negative net absorption of 1,900 units in early 2023 marked an improvement from the previous quarter’s negative 14,000 units, and CBRE said it expects absorption will turn positive in during the current quarter.

“The multifamily sector has been in search of stability after experiencing two significant shifts,” said Matt Vance, Americas Head of Multifamily Research for CBRE. “First, the Fed began raising interest rates rapidly and then multifamily fundamentals abruptly changed course as supply growth began to outstrip demand.”

Vance said the good news is the data over the past six months suggests the market is stabilizing. “Vacancy is still climbing, but much less quickly as demand regains its footing,” he said.

CBRE reported the average monthly net effective rent increased by 4.5% year-over-year in the first quarter, down significantly from the record 15.3% increase in early 2022, but well above the pre-pandemic, five-year average of 2.7%.

Nearly 59,000 new construction deliveries in early 2023 brought the four-quarter total to 332,200–slightly lower than last year’s 343,300 total, CBRE said. “Construction timelines remain elevated and should help smooth out the delivery of the significant pipeline of new product underway,” the report said.

Report highlights include:

• The Northeast/Mid-Atlantic and Midwest regions supplanted the Southeast for the highest year-over-year rent growth in the first quarter. The Northeast/Mid-Atlantic region led with 5.7% growth and the Midwest experienced 5.4% rent growth, followed by the Southeast (4.9%), South-Central (4.2%), Pacific (3.6%) and the Mountain West (1.4%), CBRE said.

• Slightly more than half of the 69 markets CBRE tracked saw positive net absorption in the first quarter, led by Orlando (3,200 units), Charlotte (1,300) and Nashville (1,200).

• Top markets for new deliveries over the past four quarters (New York, Washington, D.C., Dallas, Austin and Phoenix) accounted for well over a quarter of the national total.