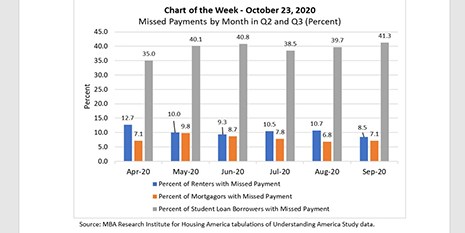

This week’s MBA Chart of the Week chart provides fresh third quarter 2020 insights on the Research Institute for Housing America’s special report released in September that highlighted household financial distress during the second quarter—the first three months of the pandemic.

Tag: Mortgage Delinquencies

MBA Chart of the Week: Missed Payments By Month (Q2-Q3)

This week’s MBA Chart of the Week chart provides fresh third quarter 2020 insights on the Research Institute for Housing America’s special report released in September that highlighted household financial distress during the second quarter—the first three months of the pandemic.

RIHA Study: More than 6 Million Renters and Homeowners and 26 Million Student Debt Borrowers Missed September Payment

More than six million households did not make their rent or mortgage payments, and 26 million individuals missed their student loan payment in September, according to third quarter research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

RIHA Study: More than 6 Million Renters and Homeowners and 26 Million Student Debt Borrowers Missed September Payment

More than six million households did not make their rent or mortgage payments, and 26 million individuals missed their student loan payment in September, according to third quarter research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

RIHA Study: More than 6 Million Renters and Homeowners and 26 Million Student Debt Borrowers Missed September Payment

More than six million households did not make their rent or mortgage payments, and 26 million individuals missed their student loan payment in September, according to third quarter research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

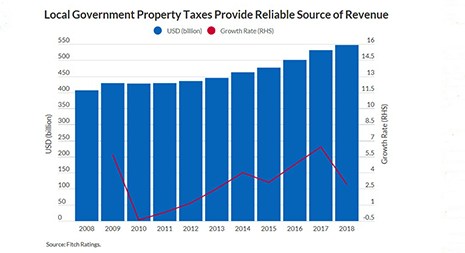

Fitch: Mortgage Delinquencies Won’t Affect Property Tax Payments

Fitch Ratings, New York, does not expect fiscal 2021 property tax collections to be meaningfully affected by mortgage forbearance programs or delinquencies, but potential for timing delays is “elevated.”

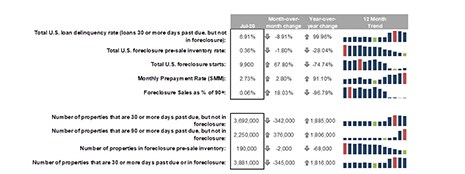

Black Knight First Look: Early-Stage Delinquencies Improve, Serious Past-Due Loans Rise

Black Knight, Jacksonville, Fla., issued its monthly First Look Mortgage Monitor, reporting the divergence between early-stage delinquencies and seriously past-due mortgages continues to widen as fewer delinquent loans cured to current status in August.

Black Knight: Mixed Results on Delinquencies; Monthly Prepayment Activity Hits 16-Year High

Black Knight, Jacksonville, Fla., said its “First Look” Mortgage Monitor showed while overall delinquencies continued to show improvement, serious delinquencies rose by 376,000 and are now up more than 1.8 million from their pre-pandemic levels.

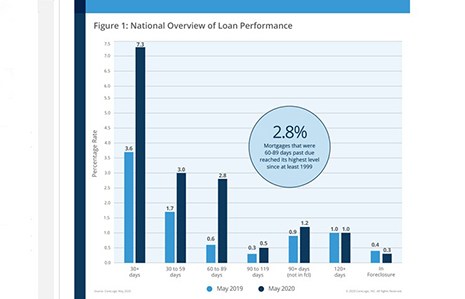

CoreLogic: ‘Clouds on The Horizon’ for Many U.S. Homeowners as Delinquency Rates Climb

Ahead of next week’s 2nd Quarter National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said early-stage and adverse mortgage delinquency rates increased for the second consecutive month, with all 50 states and more than 75% of U.S. metro areas seeing increases in overall delinquency rates.

Fitch: Borrowers Skipping Payments on Home Loans More Often Than Other Debt

Residential mortgage borrowers are missing more payments and taking advantage of payment holiday programs at a higher rate than comparable-credit borrowers of auto loans and credit cards, said Fitch Ratings New York.