CoreLogic: ‘Clouds on The Horizon’ for Many U.S. Homeowners as Delinquency Rates Climb

Ahead of this week’s 2nd Quarter National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said early-stage and adverse mortgage delinquency rates increased for the second consecutive month, with all 50 states and more than 75% of U.S. metro areas seeing increases in overall delinquency rates.

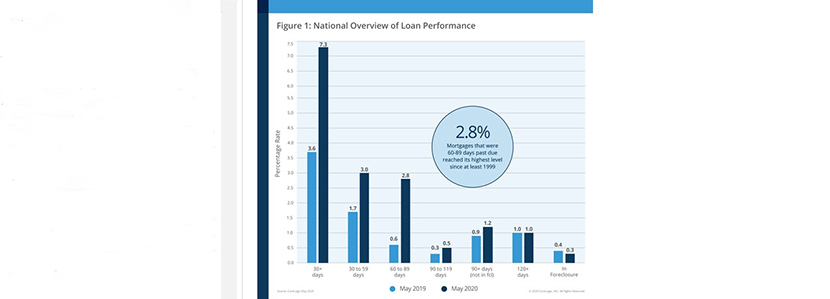

The company’s monthly Loan Performance Insights Report for May showed on a national level, 7.3% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), a 3.7-percentage point increase in the overall delinquency rate compared to 3.6% a year ago. Other data:

–Early-Stage Delinquencies (30 to 59 days past due): 3%, up from 1.7% a year ago.

–Adverse Delinquency (60 to 89 days past due): 2.8%, up from 0.6% a year ago.

–Serious Delinquency (90 days or more past due, including loans in foreclosure): 1.5%, up from 1.3% a year ago, the first year-over-year increase in the serious delinquency rate since November 2010.

–Foreclosure Inventory Rate (share of mortgages in some stage of the foreclosure process): 0.3%, down from 0.4% a year ago, the second consecutive month the U.S. foreclosure rate was at its lowest level for any month since at least January 1999.

–Transition Rate (share of mortgages that transitioned from current to 30 days past due): 2.2%, up from 0.8% a year ago. By comparison, in January 2007 — just before the start of the financial crisis — the current- to 30-day transition rate was 1.2%, while it peaked in November 2008 at 2%.

Frank Nothaft, Chief Economist with CoreLogic, noted in the months leading up to the pandemic, U.S. mortgage performance was showing signs of sustained improvement. The national unemployment rate matched a 50-year low in February, and overall delinquency had been on a 27-month decline. However, by May— just two months after the coronavirus was declared a global pandemic — U.S. unemployment surged past 13%, leaving more than four million homeowners (accounting for more than 8% of all mortgages) little choice but to enter a COVID-19 mortgage forbearance program.

(MBA, in its weekly Forbearance & Call Volume Survey, reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.)

“The national unemployment rate soared from a 50-year low in February 2020, to an 80-year high in April,” Nothaft said. “With the sudden loss of income, many homeowners are struggling to stay on top of their mortgage loans, resulting in a jump in non-payment.”

Absent further government programs and support, CoreLogic forecasts the U.S. serious delinquency rate to quadruple by the end of 2021, pushing 3 million homeowners into serious delinquency.

“Government and industry relief programs have helped to cushion the initial financial blow of the pandemic for millions of U.S. homeowners,” said Frank Martell, president and CEO of CoreLogic. “COVID-19 and the resulting pressures continue to influence the economic activity of many households. Barring additional intervention from the Federal and State governments, we are likely to see meaningful spikes in delinquencies over the short to medium term.”

The report said all states saw increases in overall delinquency rates in May from a year earlier. New Jersey and Nevada, both still hot spots for the virus, experienced the largest overall delinquency gains with 6.4 percentage-point increases each in May, compared to one year earlier. New York again remained atop the list with a 6.1 percentage-point increase, while Florida experienced a gain of 5.8 percentage points.

At the metro level, nearly every U.S. metropolitan area posted at least a small annual increase in their overall delinquency rate, with tourism destinations such as Miami (up 9.2 percentage points), and Kahului, Hawaii (up 8.8 percentage points), posting large increases. Odessa, Texas — which has a local economy strongly tied to the oil industry — also logged a considerable increase, posting an annual gain of 9 percentage points.

More than 75% of all metro areas logged at least a small increase in their serious delinquency rate. Odessa, Texas, and Laredo, Texas, tied for largest increase with gains of 1.1 percentage points each. McAllen, Texas; Midland, Texas and Hattiesburg, Miss., followed with gains of 0.7 percentage-points each.

MBA will release its 2nd Quarter National Delinquency Survey the week of Aug. 17. The NDS, conducted since 1953, covers nearly 40 million loans on one- to four- unit residential properties. Loans surveyed are reported by more than 100 lenders, including mortgage bank, commercial banks and thrifts.