Black Knight: Mixed Results on Delinquencies; Monthly Prepayment Activity Hits 16-Year High

Black Knight, Jacksonville, Fla., said its “First Look” Mortgage Monitor showed while overall delinquencies continued to show improvement, serious delinquencies rose by 376,000 and are now up more than 1.8 million from their pre-pandemic levels.

The report also noted prepayment activity rose again in July, reaching its highest mark since 2004.

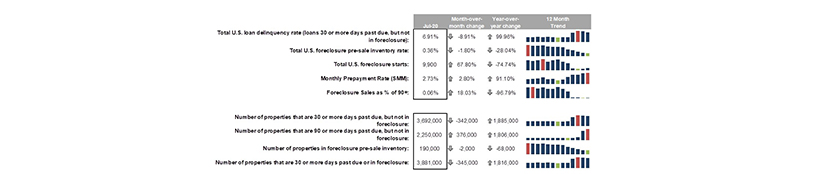

Black Knight said mortgage delinquencies continued to improve in July, falling 9% from June to just under 7 percent, totaling 3.693 million mortgages, (342,000 fewer past due mortgages). Early-stage delinquencies – loans with a single missed payment – have fallen below pre-pandemic levels, “suggesting that the initial inflow of new COVID-19-related delinquencies has subsided,” Black Knight said.

However, serious delinquencies – those 90 or more days past due – rose by 376,000 to 2.250 million and are now up more than 1.8 million from their pre-pandemic levels.

The report said foreclosure activity continues to remain muted due to widespread moratoriums; though starts rose for the month, overall activity remains near record lows. The foreclosure pre-sale inventory fell to 190,000 in July, down by 2,000 from June and down by 68,000 from a year ago. Properties that are 30 or more days past due or in foreclosure stood at 3.88 million, down by 345,000 from June but up by 1.8 million from a year ago.

Black Knight attributed the jump in the prepayment rate to 2.73 percent, a 16-year high, to low mortgage interest rates, which continue to drive both refinance and purchase activity. The prepayment rate rose by nearly 3 percent from June and by 91.1 percent from a year ago.

The report said states with the highest non-current mortgage rates were Mississippi, Louisiana, New York, Hawaii and New Jersey; states with the lowest non-current rates were Idaho, Washington, Montana, Oregon and Colorado. States with the highest rate of 90-day plus delinquencies were Mississippi, Louisiana, Nevada, New Jersey and Alaska.