The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.88% of all loans outstanding at the end of the fourth quarter of 2023, according to the Mortgage Bankers Association’s National Delinquency Survey.

Tag: Mortgage Delinquencies

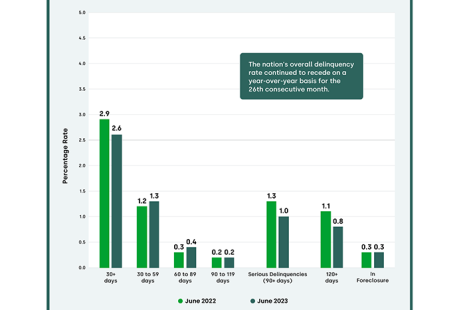

CoreLogic: No U.S. State Posts Annual Mortgage Delinquency Increases in June

U.S. mortgage performance remained exceptionally strong in June, with both overall delinquency and foreclosure rates at or near historic lows, reported CoreLogic, Irvine, Calif.

CoreLogic: No U.S. State Posts Annual Mortgage Delinquency Increases in June

U.S. mortgage performance remained exceptionally strong in June, with both overall delinquency and foreclosure rates at or near historic lows, reported CoreLogic, Irvine, Calif.

Fannie Mae, Freddie Mac Complete 52,469 4Q Foreclosure Prevention Actions

Fannie Mae and Freddie Mac completed 52,469 foreclosure prevention actions during the fourth quarter, raising the total number of homeowners who have been helped to 6.7 million since September 2008, the Federal Housing Finance Agency reported.

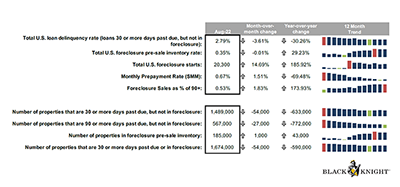

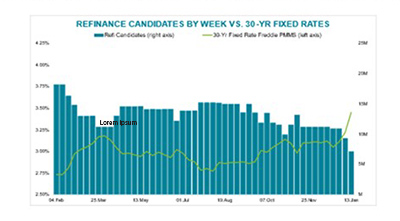

Black Knight: August Mortgage Delinquencies Near Record Low

Black Knight, Jacksonville, Fla., said mortgage delinquencies fell in August to near record lows, although foreclosure starts increased by 15 percent from July.

CoreLogic: 30 Years After Hurricane Andrew, Problems Persist for Insurance, Mortgage Industries

CoreLogic, Irvine, Calif., said in the 30 years since Hurricane Andrew devastated much of South Florida, the risk management landscape has evolved “tremendously.” But many questions remain—and with South Florida still a popular place to live, many of the risks from 1992 still exist today.

Black Knight: Foreclosures at Record Low—But…

Black Knight, Jacksonville, Fla., reported just 0.24 percent of loans in active foreclosure in December, a record low, but cautioned that mortgage delinquency rates remain more than two times pre-pandemic levels.

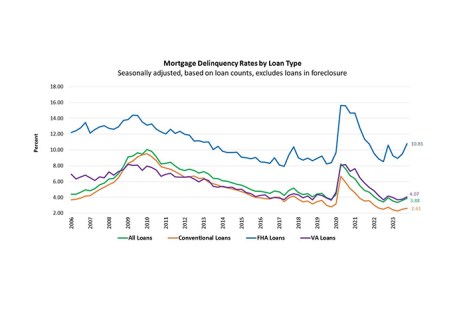

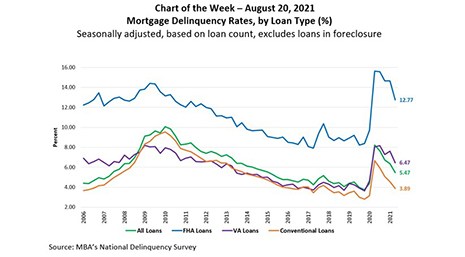

MBA Chart of the Week Aug. 23 2021: Mortgage Delinquency Rates, by Loan Type (%)

This week’s MBA Chart of the Week takes a look at mortgage delinquency rates by loan type (%) since 2006.

Black Knight: Past-Due Loans Continue to Improve

Black Knight, Jacksonville, Fla., said the national delinquency rate rose to 4.73% from 4.66% in April, although the increase was driven largely by the three-day Memorial Day weekend foreshortening available payment windows. Overall, it said past-due loan rates continued to improve.

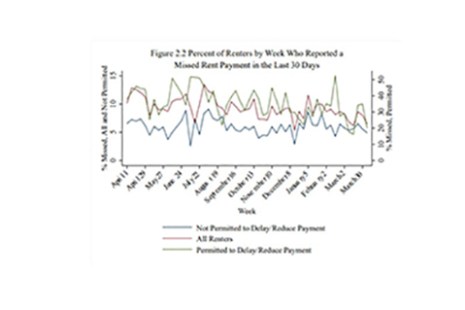

RIHA: Less Than 10% of Homeowners, Renters Have Missed Multiple Payments During Pandemic

Slightly under five million households did not make their rent or mortgage payments in March, an improvement from December 2020 and the lowest number since the onset of the COVID-19 pandemic, new research from the Mortgage Bankers Association’s Research Institute for Housing America reported.