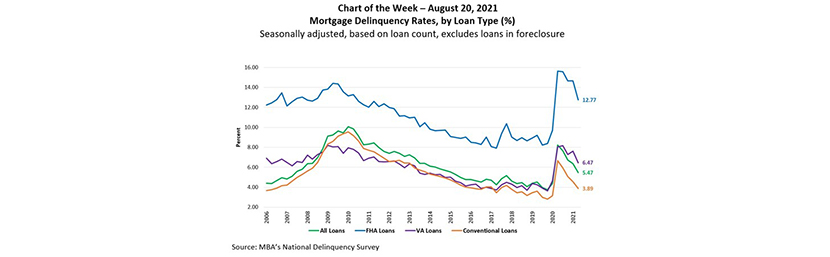

MBA Chart of the Week Aug. 23 2021: Mortgage Delinquency Rates, by Loan Type (%)

The delinquency rate for mortgage loans on one‐to‐four‐unit residential properties fell to a seasonally adjusted rate of 5.47 percent of all loans outstanding at the end of the second quarter of 2021. The delinquency rate was down 91 basis points from this year’s first quarter, and was 275 points lower than one year ago, according to the Mortgage Bankers Association’s (MBA) latest National Delinquency Survey, released last week.

This week’s MBA Chart of the Week takes a look at mortgage delinquency rates by loan type (%) since 2006.

Mortgage delinquencies decreased from the previous quarter across all loan types – FHA, VA and conventional. The FHA delinquency rate declined by 190 basis points– the largest single‐quarter decline reported in MBA’s National Delinquency Survey data series. The VA delinquency rate declined by 115 basis points – another record decline in the survey – and the conventional delinquency rate declined by 68 basis points. On a year‐over‐year basis, the overall mortgage delinquency rate decreased 288 basis points for FHA loans, decreased 158 basis points for VA loans, and decreased 279 basis points for conventional loans.

Much of the second-quarter improvement can be traced to a drop in later-stage delinquent loans – those 90 days or past due, but not in foreclosure– across all loan types. It appears that borrowers in later stages of delinquency are recovering due to several factors, including improved employment and other economic conditions, the availability of home retention workout options after forbearance and a strong housing market that is bringing additional alternatives to distressed homeowners.

–Anh Doan adoan@mba.org; Marina Walsh, CMB mwalsh@mba.org.