Black Knight: August Mortgage Delinquencies Near Record Low

Black Knight, Jacksonville, Fla., said mortgage delinquencies fell in August to near record lows, although foreclosure starts increased by 15 percent from July.

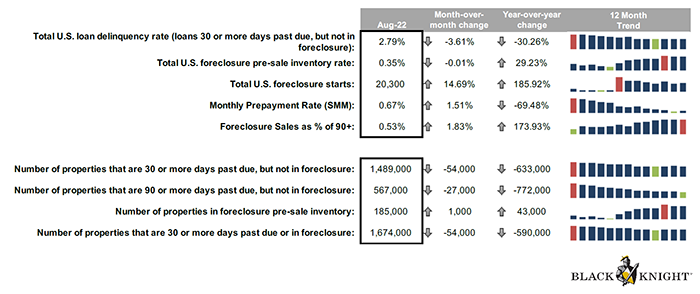

The company’s First Look Mortgage Monitor report said the national delinquency rate fell by 3.6 percent in August to 2.79 percent, four basis points above May’s record low. Improvement was broad-based, with the number of borrowers a single payment past due falling by 4% and those 90 or more days delinquent down 4.5%.

The report said after dropping steadily over recent months, cure activity also improved in August, with 62,000 seriously delinquent loans curing to current status, up from 58,000 in July.

Black Knight also reported 20,300 foreclosure starts, a 15% jump in activity from July. However, it remains 44% below August 2019 levels. Likewise, starts were initiated on 3.4% of serious delinquencies; up slightly from July but still less than half the rate seen in the years leading up to the pandemic.

The report also said prepayments edged up 1.5% for the month, due to calendar-related effects, but are still down by 69% year-over-year as rising rates continue to put downward pressure on both purchase and refinance lending.

Other report findings:

–Foreclosure inventory rate: 0.35 percent, down by 0.01 percent from July but up by 29.23 percent from a year ago.

–Foreclosure starts: 20,300, up by 14.69 percent from July and up by 185.92 percent from a year ago.

–Monthly prepayment rate: 0.67 percent, up by 1.51 percent from July but down by 69.48 percent from a year ago.

–Properties 30 or more days past due, but not in foreclosure: 1,489,000, down by 54,000 from July and down by 633,000 from a year ago.

–Properties 90 or more days past due, but not in foreclosure: 567,000, down by 27,000 from July and down by 772,000 from a year ago.

–Properties in foreclosure pre-sale inventory: 185,000, up by 1,000 from July and up by 43,000 from a year ago.

–Properties 30 or more days past due or in foreclosure: 1,674,000, down by 54,000 and down by 590,000 from a year ago.

–States with highest percentage of non-current loans: Mississippi, Louisiana, Alabama, Oklahoma, West Virginia.

–States with lowest percentage of non-current loans: Washington, Idaho, Colorado, California, Oregon.